There’s a stale old joke: “There are two types of people – those who believe there are two types of people, and those who don’t.” We can modify that joke: “There are two types of people – those who know there are three types of supply chain analytics, and those who haven’t yet read this blog.”

The three types of supply chain analytics are “descriptive”, “predictive”, and “prescriptive.” Each plays a different role in helping you manage your inventory. Modern supply chain software lets you exploit all three.

Descriptive Analytics

Descriptive Analytics are the stuff of dashboards. They tell you “what’s happenin’ now.” Included in this category are such summary numbers as dollars currently invested in inventory, current customer service level and fill rate, and average supplier lead times. These statistics are useful for keeping track of your operations, especially when you track changes in them from month to month. You will rely on them every day. They require accurate corporate databases, processed statistically.

Predictive Analytics

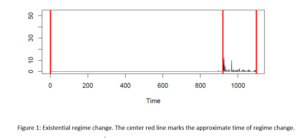

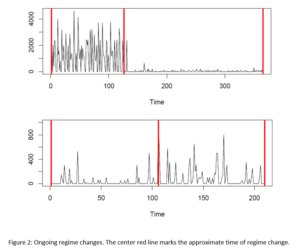

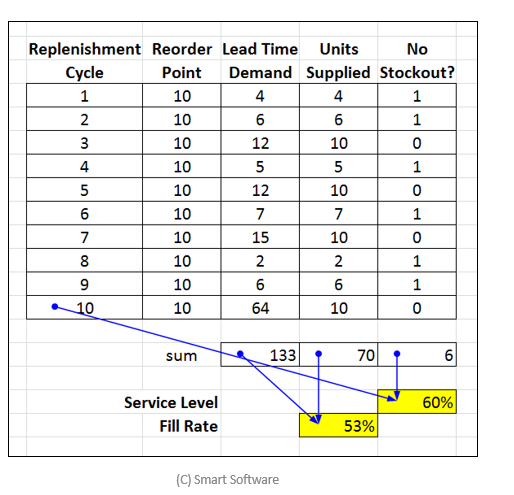

Predictive Analytics most commonly manifest as forecasts of demand, often broken down by product and location and sometimes also by customer. These statistics provide early warning so you can gear up production, staffing and raw material procurement to satisfy demand. They also provide predictions of the effect of changes in operating policies, e.g., what happens if we increase our order quantity for Product X from 20 to 25 units? You might rely on Predictive Analytics periodically, perhaps weekly or monthly, when you look up from what’s happening now to see what will happen next. Predictive Analytics uses Descriptive Analytics as a foundation but adds more capability. Predictive Analytics for demand forecasting requires advanced statistical processing to detect and estimate such features of product demand as trend, seasonality and regime change. Predictive Analytics for inventory management uses forecasts of demand as inputs into models of the operation of inventory policies, which in turn provide estimates of key performance metrics such as service levels, fill rates, and operating costs.

Prescriptive Analytics

Prescriptive Analytics are not about what is happening now, or what will happen next, but about what you should do next, i.e., they recommend decisions aimed at maximizing inventory system performance. You might rely on Prescriptive Analytics to best posture your entire inventory policy. Prescriptive Analytics uses Predictive Analytics as a foundation then adds optimization capability. For instance, Prescriptive Analytics software can automatically work out the best choices for future values of Min’s and Max’s for thousands of inventory items. Here, “best” might mean the values of Min and Max for each item that minimize operating cost (the sum of holding, ordering, and shortage costs) while maintaining a 90% floor on item fill rate.

Example

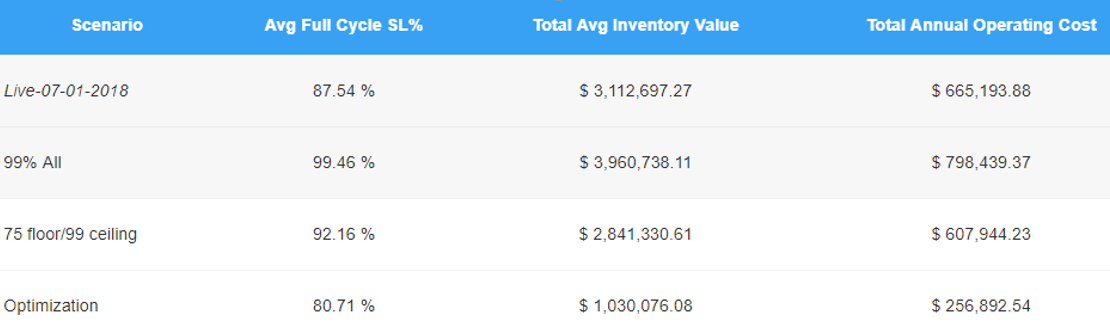

The figure below shows how supply chain analytics can help the inventory manager. The columns show three predicted Key Performance Indicators (KPI’s): service level, inventory investment, and operating costs (holding costs + ordering costs + shortage costs).

Figure 1: The three types of analytics used to evaluate planning scenarios

The rows show four alternative inventory policies, expressed as scenarios. The “Live” scenario reports on the values of the KPI’s on July 1, 2018. The “99% All” scenario changes the current policy by raising the service level of all items to 99%. The “75 floor/99 ceiling” scenario raises service levels that are too low up to 75% and lowers very high (i.e., expensive) service levels down to 95%. The “Optimization” scenario prescribes item specific service levels that minimizes total operating costs.

The “Live 07-01-2018” scenario is an example of Descriptive Analytics. It shows the current baseline performance. The software then allows the user to try out changes in inventory policy by creating new “What If” scenarios that might then be converted to named scenarios for further consideration. The next two scenarios are examples of Predictive Analytics. They both assess the consequences of their recommended inventory control policies, i.e., recommended values of Min and Max for all items. The “Optimization” scenario is an example of Prescriptive Analytics because it recommends a best compromise policy.

Consider how the three alternative scenarios compare to the baseline “Live” scenario. The “99% All” scenario raises the item availability metrics, increasing service level from 88% to 99%. However, doing so increases the total inventory investment from $3 million to about $4 million. In contrast, the “75 floor/99 ceiling” scenario increases both service level and reduces the cash tied up in inventory by about $300,000. Finally, the “Optimization” scenario achieves an 80% service level, a reduction from the current 88%, but it cuts more than $2 million from the inventory value and reduces operating costs by more than $400,000 annually. From here, managers could try further options, such as giving back some of the $2 million savings to achieve a higher average service level.

Summary

Modern software packages for inventory planning and inventory optimization should offer three kinds of supply chain analytics: Descriptive, Predictive, and Prescriptive. Their combination lets inventory managers track their operations (Descriptive), forecast where their operations will be in the future (Predictive), and optimize their inventory policies in response in anticipation of future conditions (Prescriptive).

Related Posts

Smart Software to Present at Community Summit North America

Smart Software’s Channel Sales Director and Enterprise Solution Engineer, to present three sessions at this year’s Microsoft Dynamics Community Summit North America event in Orlando, FL.

.

Smart Software to lead a webinar as part of the WERC Solutions Partner Program

Smart Software, will lead a 30-minute webinar as part of the WERC Solutions Partner Program. The presentation will focus on how a leading Electric Utility implemented Smart Inventory Planning and Optimization (Smart IP&O) as part of the company’s strategic supply chain optimization (SCO) initiative.

The Supply Chain Blame Game: Top 3 Excuses for Inventory Shortage and Excess

The supply chain has become the blame game for almost any industrial or retail problem. Shortages on lead time variability, bad forecasts, and problems with bad data are facts of life, yet inventory-carrying organizations are often caught by surprise when any of these difficulties arise. So, again, who is to blame for the supply chain chaos? Keep reading this blog and we will try to show you how to prevent product shortages and overstocking.

Forecasting is a means to an end. The end is to optimize inventory levels. Because demand is uncertain, companies that need to provide even moderate service levels must stock more than the forecast, often much more. But doesn’t low forecast error mean lower safety stock? The better my forecasts, the lower my inventory? Yes, true. But what matters when determining the required inventory are both accurate forecasts of the most likely demand and accurate estimates of the variability around the most likely demand.

Forecasting is a means to an end. The end is to optimize inventory levels. Because demand is uncertain, companies that need to provide even moderate service levels must stock more than the forecast, often much more. But doesn’t low forecast error mean lower safety stock? The better my forecasts, the lower my inventory? Yes, true. But what matters when determining the required inventory are both accurate forecasts of the most likely demand and accurate estimates of the variability around the most likely demand.