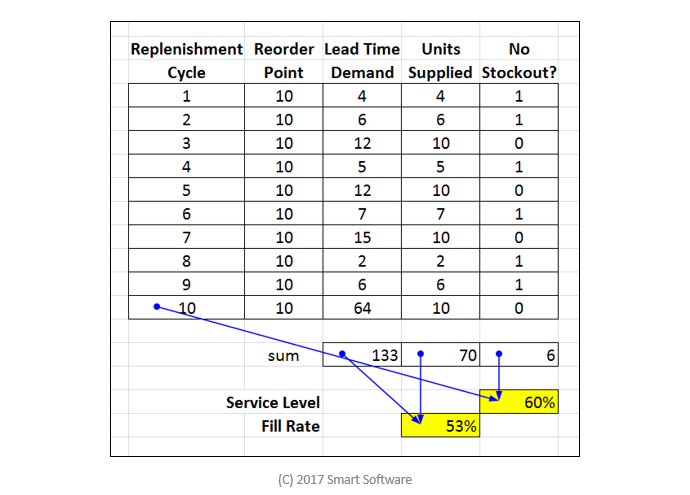

Service level is a key performance indicator for companies that put a premium on satisfying customer demand. Service level is defined as the probability of surviving a replenishment lead time without stocking out.

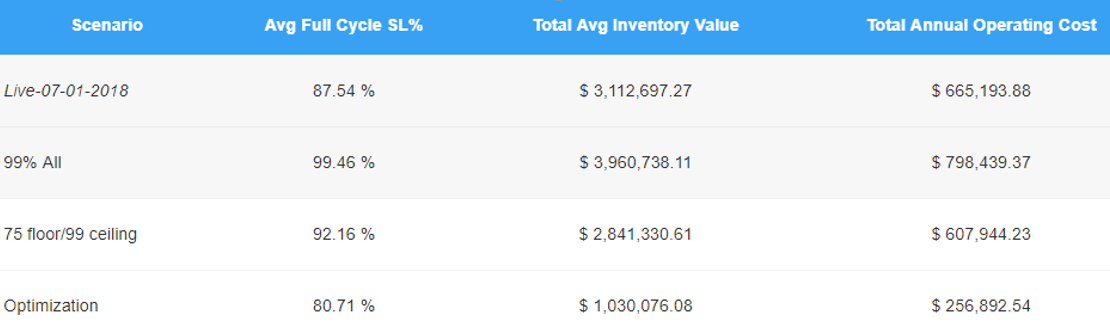

Inventory management best practice begins with setting service level targets, then calculates reorder points (also called Mins) to achieve those targets. These calculations should account for variability in both demand and replenishment lead time. There are many software systems available for doing these calculations. If everything works out, the achieved service level ends up very close to the target service level. Unfortunately, there is often a painful gap between the two.

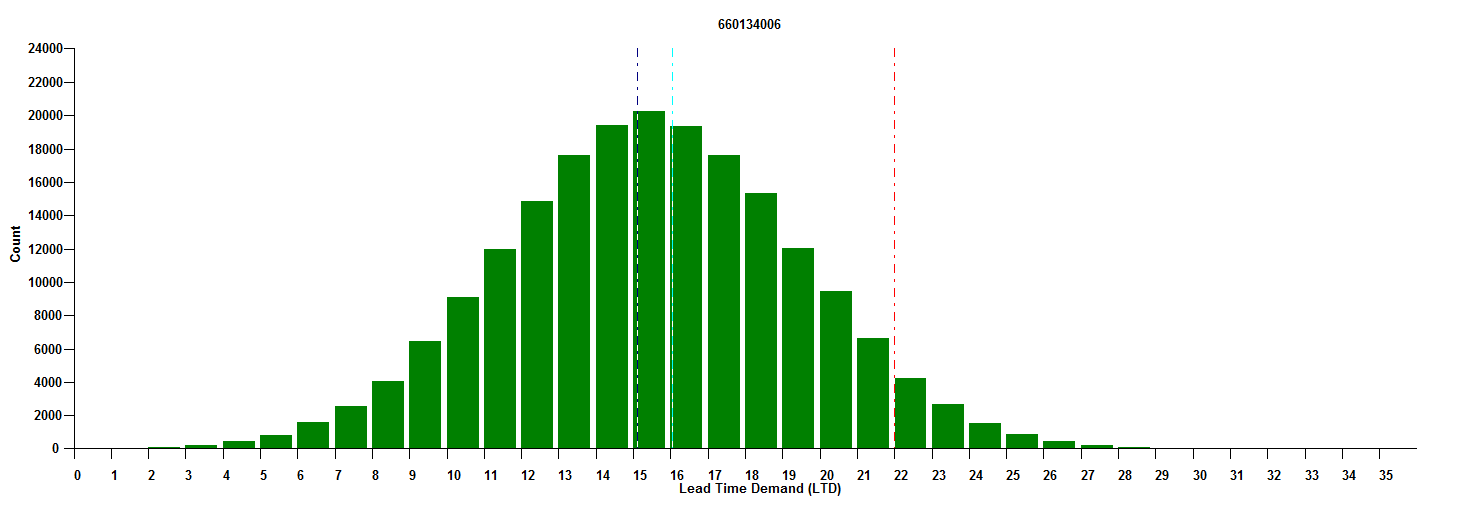

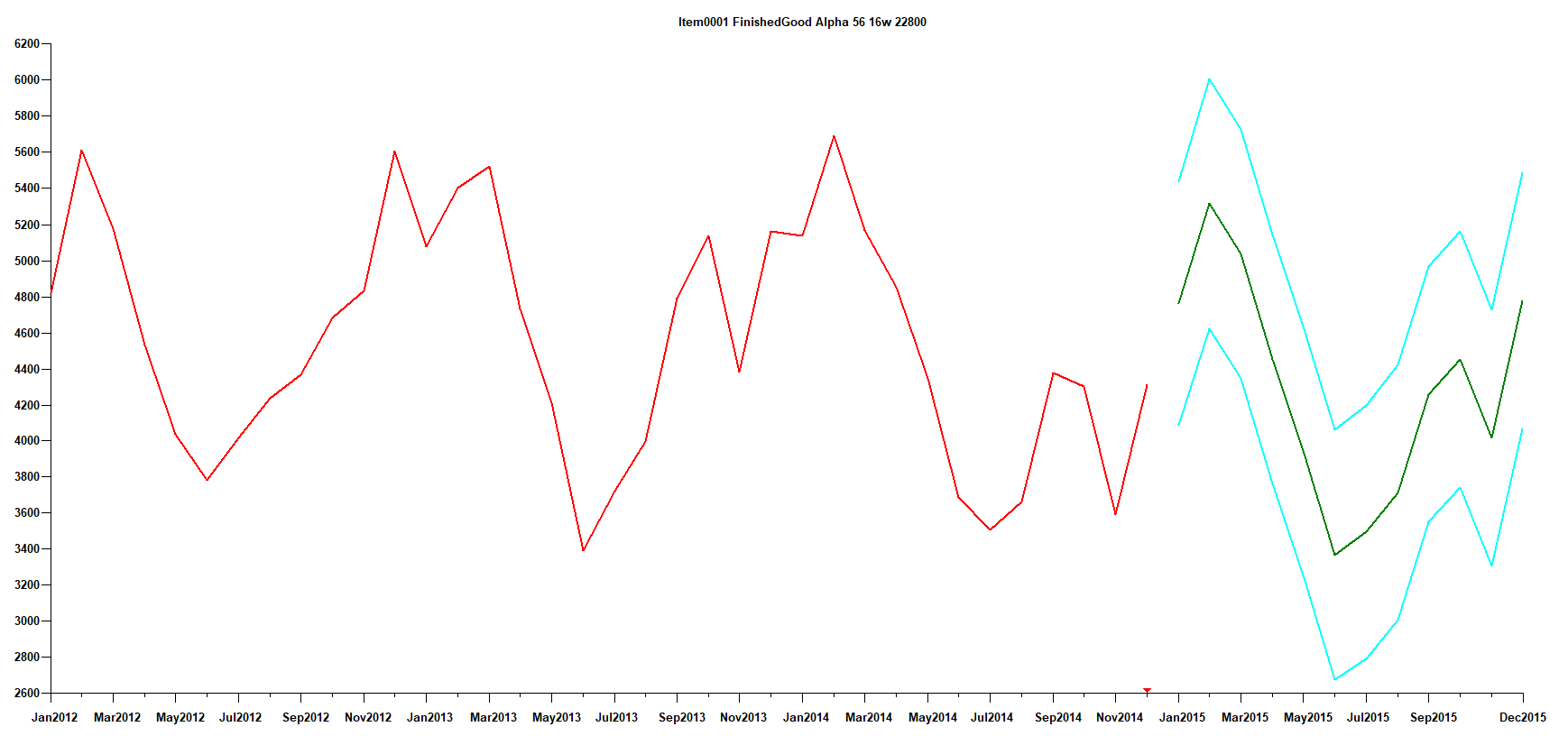

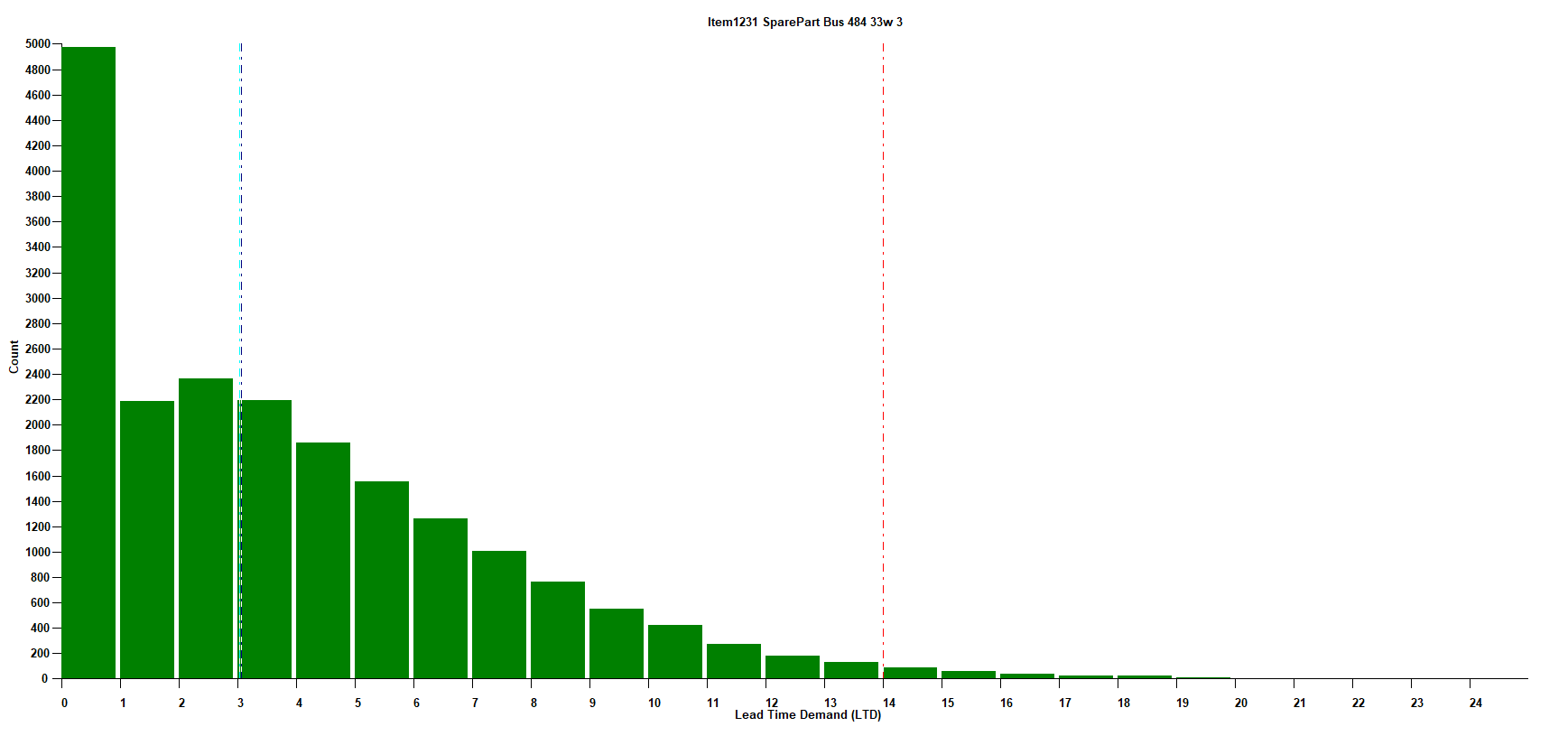

One reason for the gap is unrealistic models of demand. In many cases, software for calculating reorder points uses textbook formulas based on mathematical assumptions that make analysis simple at the expense of realism. Many “Inventory 101” textbooks use formulas that assume demand has a Normal distribution (a.k.a. the “bell-shaped curve”) for finished goods and the Poisson distribution for spare parts. Fortunately, there are now inventory optimization and forecasting systems that process the actual demand histories of the inventory items using probabilistic forecasting. These solutions calculate an accurate estimate of the distribution – not some idealized version. To learn more check out this past blog on probabilistic forecasting:

But there is a second source of error in textbooks that operates invisibly in many inventory software package: “undershoot”.

Calculations of reorder points almost always assume that stockouts arise when the total demand during a replenishment interval exceeds the reorder point. For example, assume that demand averages 1 unit per day. If lead time is 5 days, then on average lead time demand is 5 units. Setting the reorder point at 5 units would yield a laughable service level somewhere in the vicinity of 50%. Adding safety stock to the calculation might result in a reorder point of, say, 11 units, which might correspond to a service level of 95%. Another way to say this is, starting at a reorder point of 11 units, there should be a 95% chance of surviving the 5 day lead time without experiencing cumulative demand of more than 11 units. Theoretically!

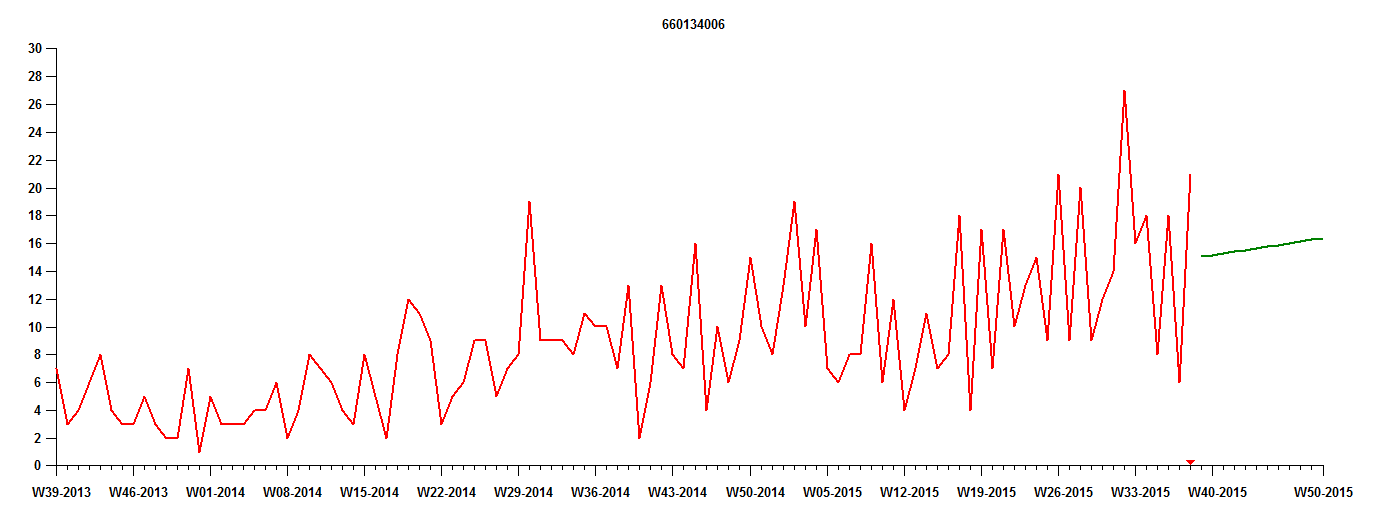

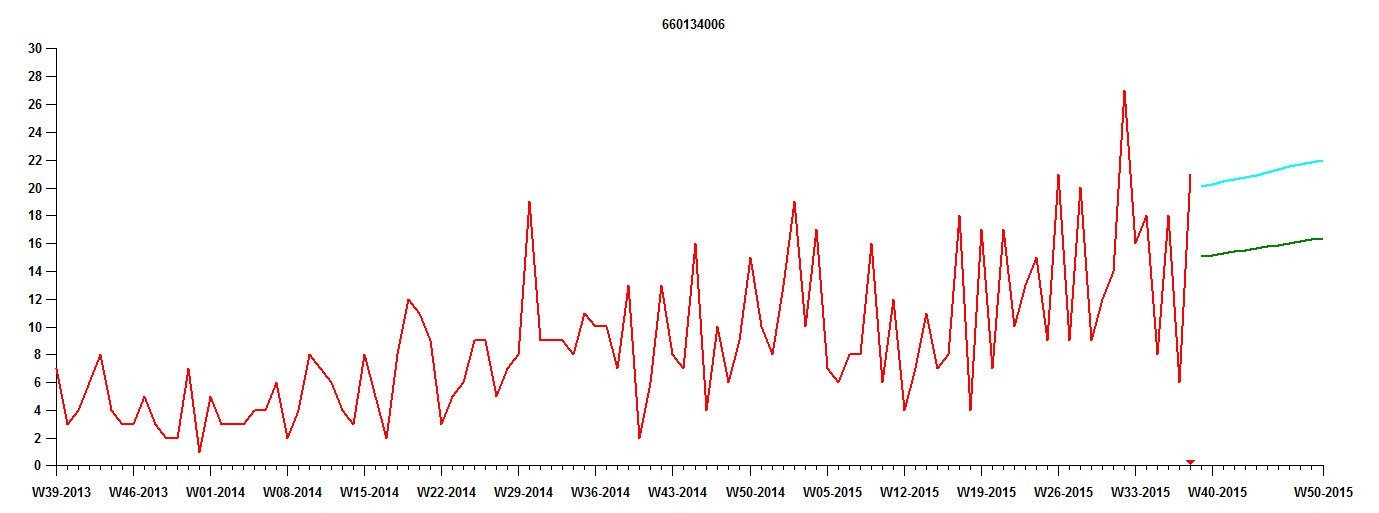

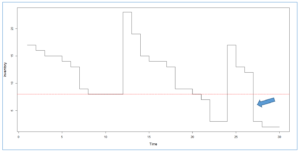

What’s missing from this analysis is the undershoot phenomenon. Undershoot means that the lead time begins not at the reorder point but below it. Undershoot happens every time the demand that breached the reorder point took the stock down below (not down to) the reorder point. The figure below shows replenishment cycles with and without undershoot. Undershoot picks your pocket before you even begin to roll the dice. It deludes the inventory professional into thinking his or her reorder points are sufficient to achieve their targets, whereas actual performance will not make the grade.

There is only one situation in which undershoot is not a worry: when demand is always either zero or one unit. In that case, undershoot is impossible. But in all other cases, undershoot is sure to happen to some extent, and it can seriously undercut the service level actually achieved by a given choice of reorder point. Our analyses show that the conditions most vulnerable to undershoot involve highly intermittent and skewed demand with very short lead times – the very conditions being made most common by market trends.

What can be done to protect yourself from the effect of undershoot on reorder point calculations? Use inventory optimization and forecasting software that isn’t tied to the old textbook assumptions and instead automatically accounts for undershoot when calculating the service level produced by any choice of reorder point.

To see Smart Software’s Inventory Optimization solution in action, register to see a recorded demo below:

Related Posts

Why MRO Businesses Need Add-on Service Parts Planning & Inventory Software

MRO organizations exist in a wide range of industries, including public transit, electrical utilities, wastewater, hydro power, aviation, and mining. To get their work done, MRO professionals use Enterprise Asset Management (EAM) and Enterprise Resource Planning (ERP) systems. These systems are designed to do a lot of jobs. Given their features, cost, and extensive implementation requirements, there is an assumption that EAM and ERP systems can do it all. In this post, we summarize the need for add-on software that addresses specialized analytics for inventory optimization, forecasting, and service parts planning.

Head to Head: Which Service Parts Inventory Policy is Best?

Our customers have usually settled into one way to manage their service parts inventory. The professor in me would like to think that the chosen inventory policy was a reasoned choice among considered alternatives, but more likely it just sort of happened. Maybe the inventory honcho from long ago had a favorite and that choice stuck. Maybe somebody used an EAM or ERP system that offered only one choice. Perhaps there were some guesses made, based on the conditions at the time.

Leveraging ERP Planning BOMs with Smart IP&O to Forecast the Unforecastable

In a highly configurable manufacturing environment, forecasting finished goods can become a complex and daunting task. The number of possible finished products will skyrocket when many components are interchangeable. A traditional MRP would force us to forecast every single finished product which can be unrealistic or even impossible. Several leading ERP solutions introduce the concept of the “Planning BOM”, which allows the use of forecasts at a higher level in the manufacturing process. In this article, we will discuss this functionality in ERP, and how you can take advantage of it with Smart Inventory Planning and Optimization (Smart IP&O) to get ahead of your demand in the face of this complexity.

Smart Operational Analytics automatically calculates historical service levels & fill rates across any item. To see how you calculate these and other operational metrics including inventory turns, supplier performance, and more register below to watch a five minute demonstration. The demo will show how our cloud platform continuously calculates and reports these metrics across thousands of items helping you identify opportunities for service level improvement and inventory reduction.

Smart Operational Analytics automatically calculates historical service levels & fill rates across any item. To see how you calculate these and other operational metrics including inventory turns, supplier performance, and more register below to watch a five minute demonstration. The demo will show how our cloud platform continuously calculates and reports these metrics across thousands of items helping you identify opportunities for service level improvement and inventory reduction.