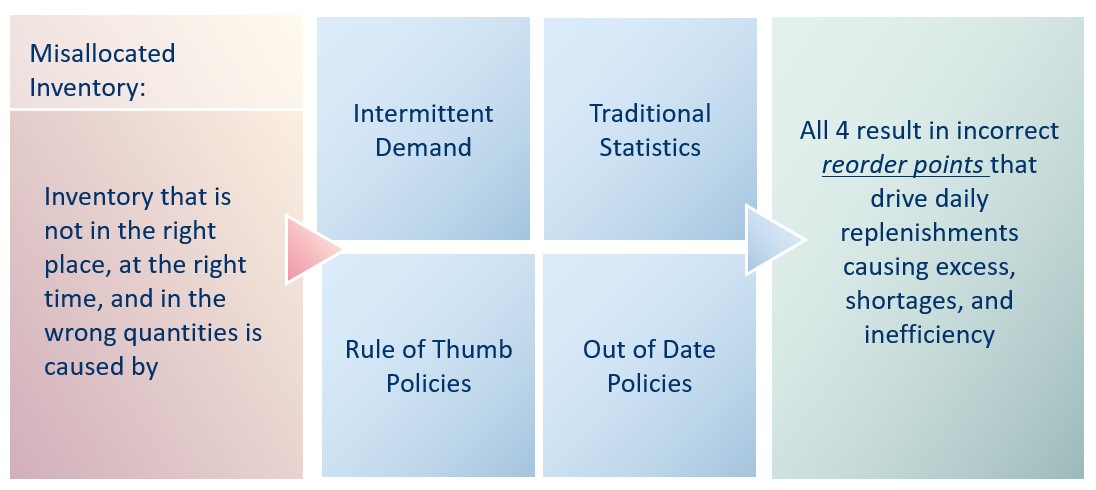

Managing spare parts presents numerous challenges, such as unexpected breakdowns, changing schedules, and inconsistent demand patterns. Traditional forecasting methods and manual approaches are ineffective in dealing with these complexities. To overcome these challenges, this blog outlines key strategies that prioritize service levels, utilize probabilistic methods to calculate reorder points, regularly adjust stocking policies, and implement a dedicated planning process to avoid excessive inventory. Explore these strategies to optimize spare parts inventory and improve operational efficiency.

Bottom Line Upfront

1.Inventory Management is Risk Management.

2.Can’t manage risk well or at scale with subjective planning – Need to know service vs. cost.

3.It’s not supply & demand variability that are the problem – it’s how you handle it.

4.Spare parts have intermittent demand so traditional methods don’t work.

5.Rule of thumb approaches don’t account for demand variability and misallocate stock.

6.Use Service Level Driven Planning (service vs. cost tradeoffs) to drive stock decisions.

7.Probabilistic approaches such as bootstrapping yield accurate estimates of reorder points.

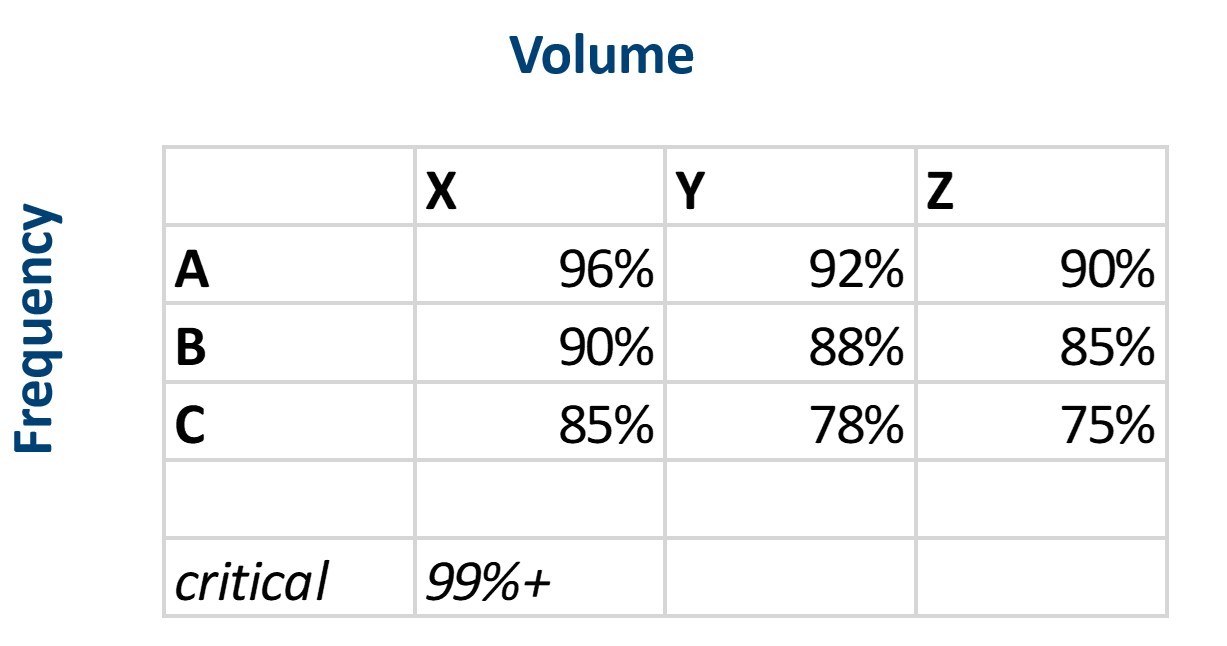

8.Classify parts and assign service level targets by class.

9.Recalibrate often – thousands of parts have old, stale reorder points.

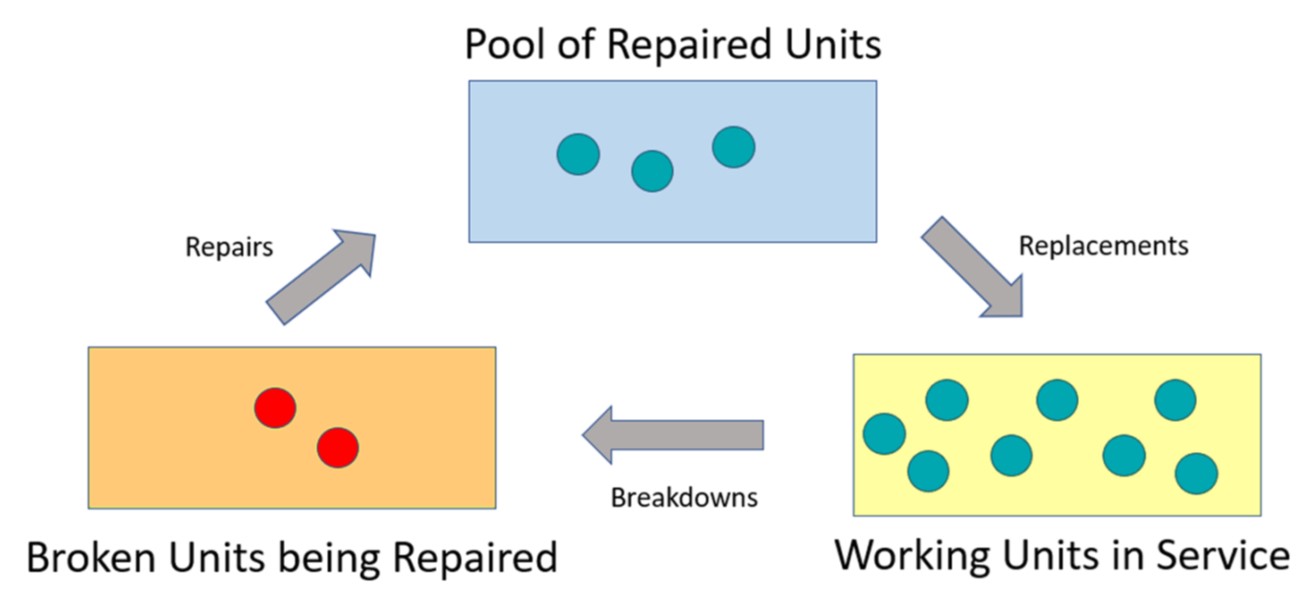

10.Repairable parts require special treatment.

Do Focus on the Real Root Causes

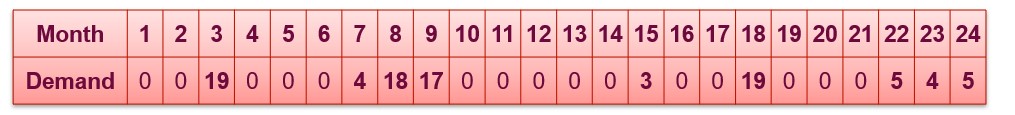

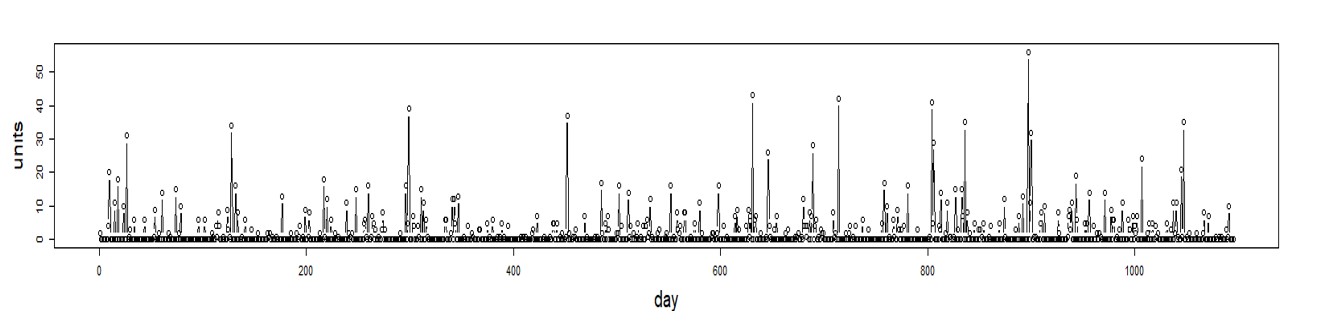

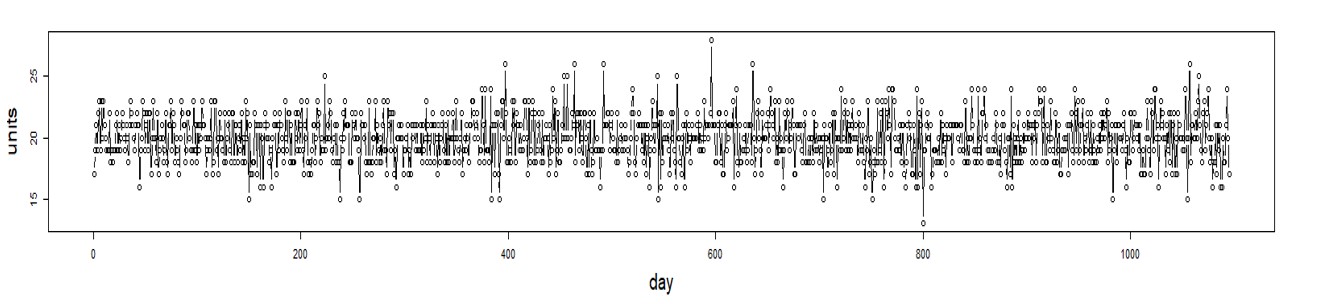

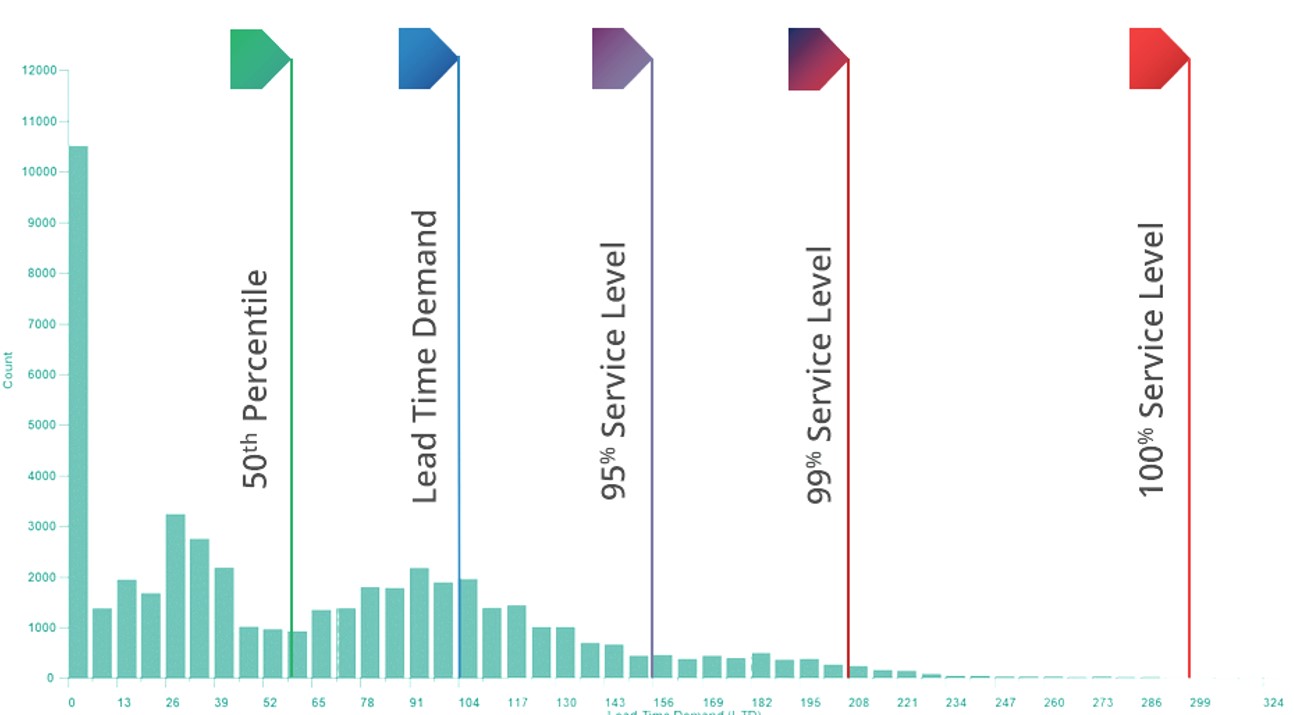

Intermittent Demand

- Slow moving, irregular or sporadic with a large percentage of zero values.

- Non-zero values are mixed in randomly – spikes are large and varied.

- Isn’t bell shaped (demand is not Normally distributed around the average.)

- At least 70% of a typical Utility’s parts are intermittently demanded.

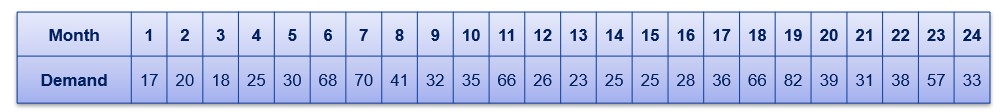

Normal Demand

- Very few periods of zero demand (exception is seasonal parts.)

- Often exhibits trend, seasonal, or cyclical patterns.

- Lower levels of demand variability.

- Is bell-shaped (demand is Normally distributed around the average.)

Don’t rely on averages

- OK for determining typical usage over longer periods of time.

- Often forecasts more “accurately” than some advanced methods.

- But…insufficient for determining what to stock.

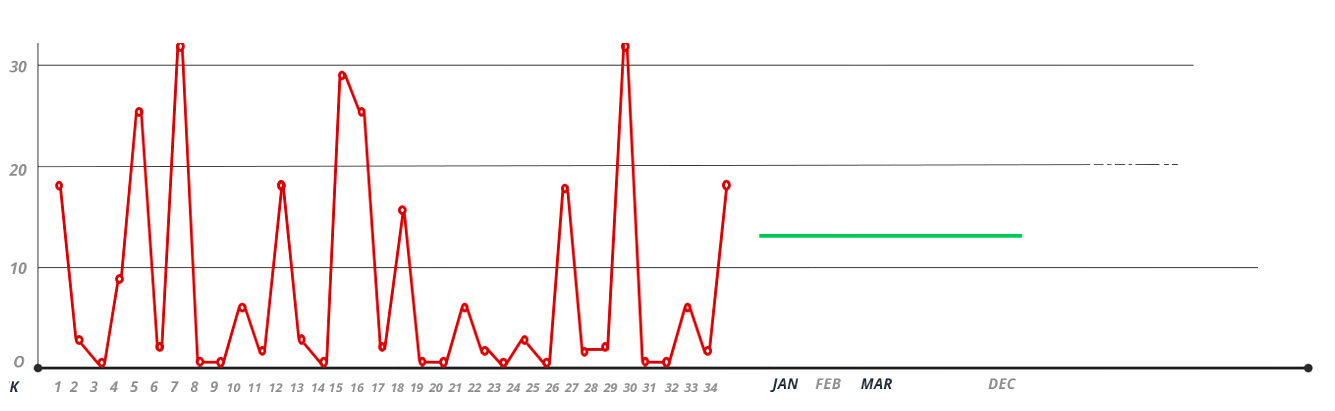

Don’t Buffer with Multiples of Averages

Example: Two equally important parts so let’s treat them the same.

We’ll order more when On Hand Inventory ≤ 2 x Avg Lead Time Demand.

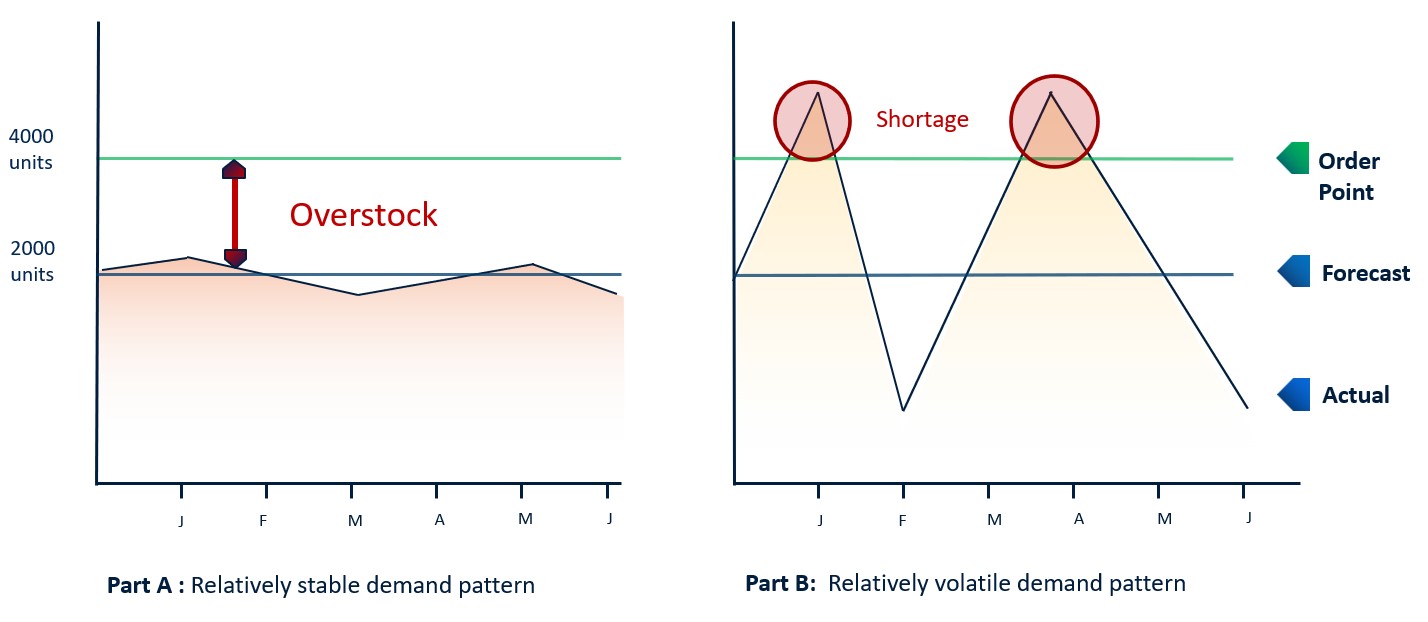

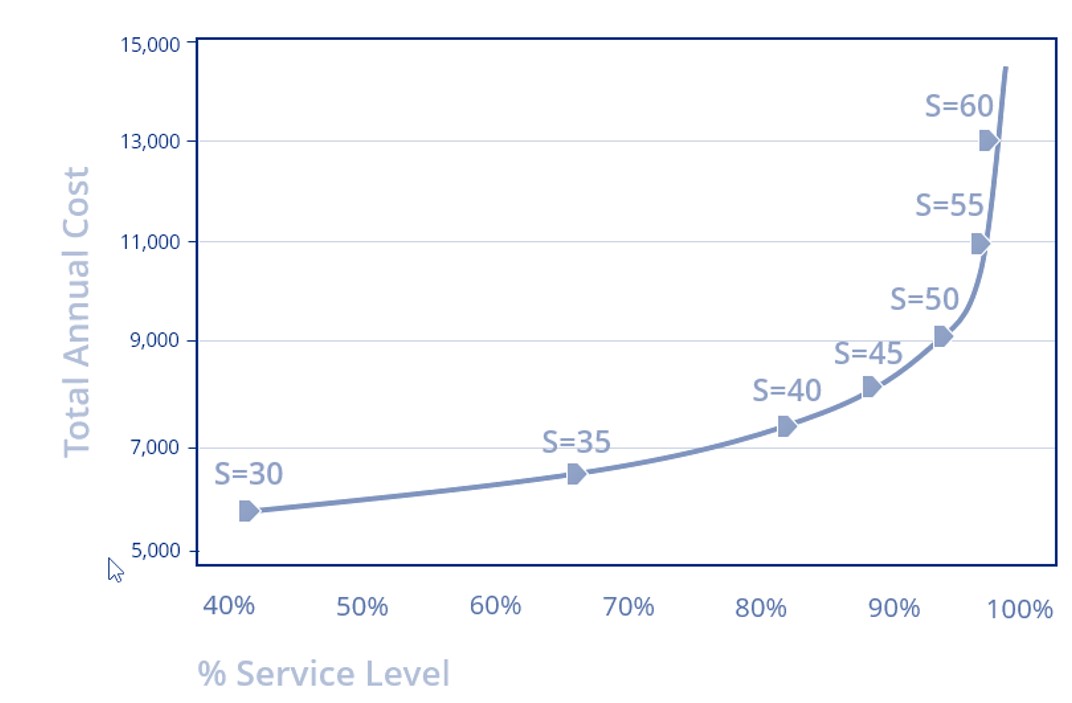

Do use Service Level tradeoff curves to compute safety stock

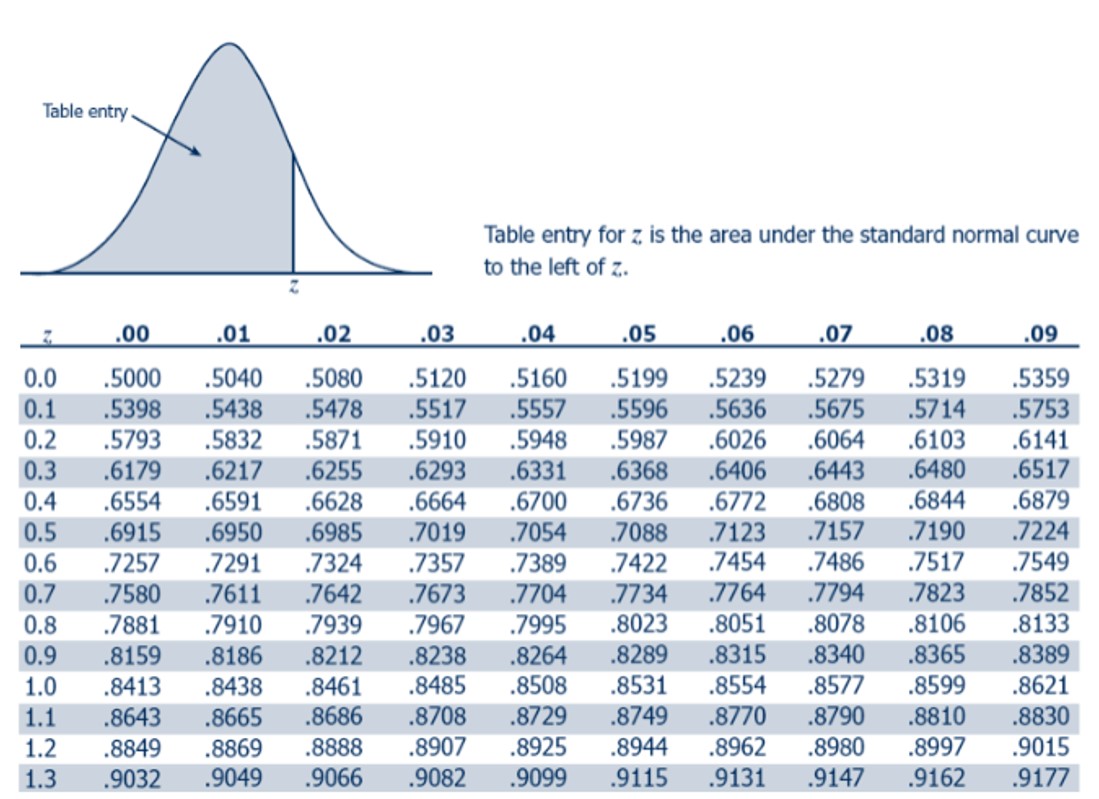

Standard Normal Probabilities

OK for normal demand. Doesn’t work with intermittent demand!

Don’t use Normal (Bell Shaped) Distributions

- You’ll get the tradeoff curve wrong:

– e.g., You’ll target 95% but achieve 85%.

– e.g., You’ll target 99% but achieve 91%.

- This is a huge miss with costly implications:

– You’ll stock out more often than expected.

– You’ll start to add subjective buffers to compensate and then overstock.

– Lack of trust/second-guessing of outputs paralyzes planning.

Why Traditional Methods Fail on Intermittent Demand:

Traditional Methods are not designed to address core issues in spare parts management.

Need: Probability distribution (not bell-shaped) of demand over variable lead time.

- Get: Prediction of average demand in each month, not a total over lead time.

- Get: Bolted-on model of variability, usually the Normal model, usually wrong.

Need: Exposure of tradeoffs between item availability and cost of inventory.

- Get: None of this; instead, get a lot of inconsistent, ad-hoc decisions.

Do use Statistical Bootstrapping to Predict the Distribution:

Then exploit the distribution to optimize stocking policies.

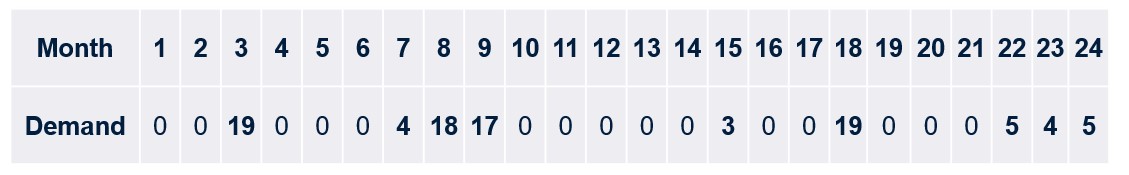

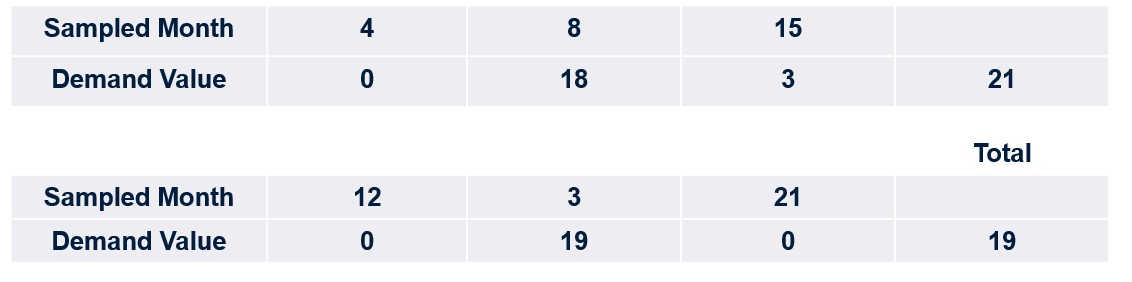

How does Bootstrapping Work?

24 Months of Historical Demand Data.

Bootstrap Scenarios for a 3-month Lead Time.

Bootstrapping Hits the Service Level Target with nearly 100% Accuracy!

- National Warehousing Operation.

Task: Forecast inventory stocking levels for 12,000 intermittently demanded SKUs at 95% & 99% service levels

Results:

At 95% service level, 95.23% did not stock out.

At 99% service level, 98.66% did not stock out.

This means you can rely on output to set expectations and confidently make targeted stock adjustments that lower inventory and increase service.

Set Target Service Levels According to Order Frequency & Size

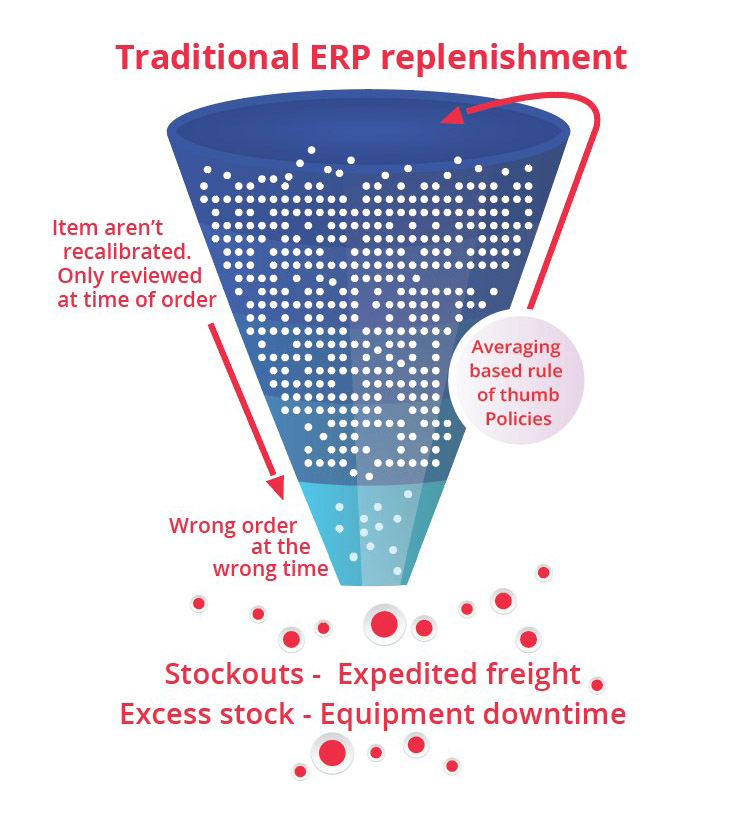

Recalibrate Reorder Points Frequently

- Static ROPs cause excess and shortages.

- As lead time increases, so should the ROP and vice versa.

- As usage decreases, so should the ROP and vice versa.

- Longer you wait to recalibrate, the greater the imbalance.

- Mountains of parts ordered too soon or too late.

- Wastes buyers’ time placing the wrong orders.

- Breeds distrust in systems and forces data silos.

Do Plan Rotables (Repair Parts) Differently

Summary

1.Inventory Management is Risk Management.

2.Can’t manage risk well or at scale with subjective planning – Need to know service vs. cost.

3.It’s not supply & demand variability that are the problem – it’s how you handle it.

4.Spare parts have intermittent demand so traditional methods don’t work.

5.Rule of thumb approaches don’t account demand variability and misallocate stock.

6.Use Service Level Driven Planning (service vs. cost tradeoffs) to drive stock decisions.

7.Probabilistic approaches such as bootstrapping yield accurate estimates of reorder points.

8.Classify parts and assign service level targets by class.

9.Recalibrate often – thousands of parts have old, stale reorder points.

10.Repairable parts require special treatment.

Spare Parts Planning Software solutions

Smart IP&O’s service parts forecasting software uses a unique empirical probabilistic forecasting approach that is engineered for intermittent demand. For consumable spare parts, our patented and APICS award winning method rapidly generates tens of thousands of demand scenarios without relying on the assumptions about the nature of demand distributions implicit in traditional forecasting methods. The result is highly accurate estimates of safety stock, reorder points, and service levels, which leads to higher service levels and lower inventory costs. For repairable spare parts, Smart’s Repair and Return Module accurately simulates the processes of part breakdown and repair. It predicts downtime, service levels, and inventory costs associated with the current rotating spare parts pool. Planners will know how many spares to stock to achieve short- and long-term service level requirements and, in operational settings, whether to wait for repairs to be completed and returned to service or to purchase additional service spares from suppliers, avoiding unnecessary buying and equipment downtime.

Contact us to learn more how this functionality has helped our customers in the MRO, Field Service, Utility, Mining, and Public Transportation sectors to optimize their inventory. You can also download the Whitepaper here.

White Paper: What you Need to know about Forecasting and Planning Service Parts

This paper describes Smart Software’s patented methodology for forecasting demand, safety stocks, and reorder points on items such as service parts and components with intermittent demand, and provides several examples of customer success.