Utilities in the electrical, natural gas, urban water and wastewater, and telecommunications fields are all asset intensive. Generation, production, processing, transmission, and distribution of electricity, natural gas, oil, and water, are all reliant on physical infrastructure that must be properly maintained, updated, and upgraded over time. Maximizing asset uptime and the reliability of physical infrastructure demands effective inventory management, spare parts forecasting, and supplier management.

A utility that executes these processes effectively will outperform its peers, provide better returns for its investors and higher service levels for its customers, while reducing its environmental impact. Impeding these efforts are out-of-date IT systems, evolving security threats, frequent supply chain disruptions, and extreme demand variability. However, the convergence of these challenges with mature cloud technology and recent advancements in data analytics, probabilistic forecasting, and technologies for data management, present utilities a generational opportunity to digitally transform their enterprise.

Here are seven digital transformations that require relatively small upfront investments but will generate seven-figure returns.

1. Inventory Management is the first step in MRO inventory optimization. It involves analyzing current inventory levels and usage patterns to identify opportunities for improvement. This should include looking for overstocked, understocked, or obsolete items. New probabilistic forecasting technology will help by simulating future parts usage and predicting how current stocking policies will perform. Pats planners can use the simulation results to proactively identify where policies should be modified.

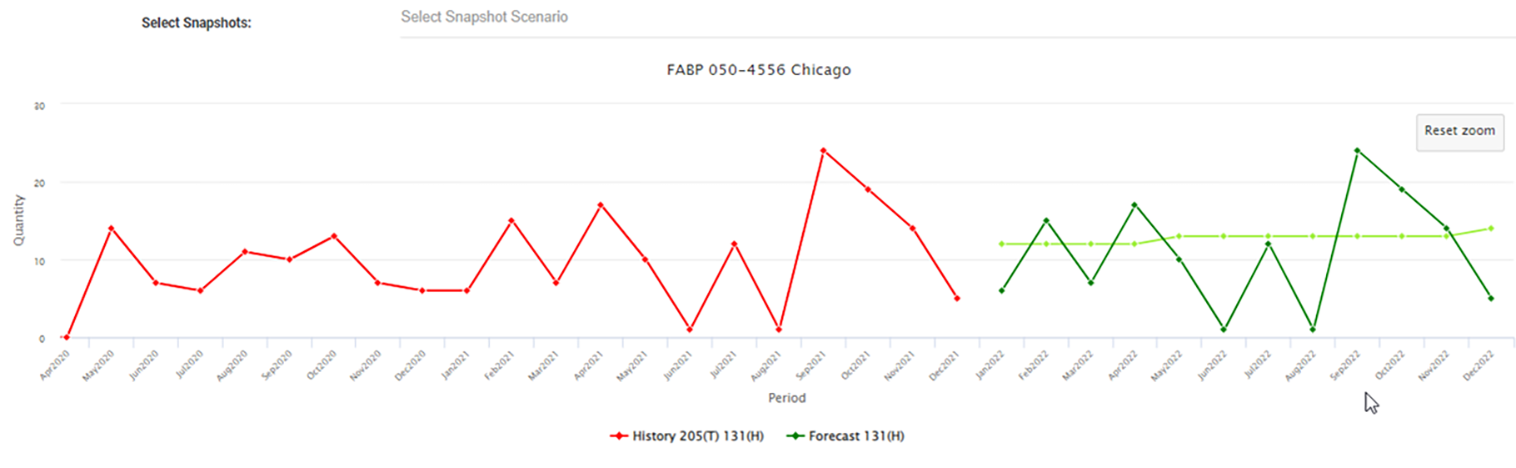

2. Accurate forecasting and demand planning are very important in optimizing MRO service parts inventories. An accurate demand forecast is a critical supply chain driver. By understanding demand patterns that result from capital projects and planned and unplanned maintenance, parts planners can more accurately anticipate future inventory needs, budget properly, and better communicate anticipated demand to suppliers. Parts forecasting software can be used to automatically house an accurate set of historical usage that details planned vs. unplanned parts demand.

3. Managing suppliers and lead times are important components of MRO inventory optimization. It involves selecting the best vendors for the job, having backup suppliers that can deliver quickly if the preferred supplier fails, and negotiating favorable terms. Identifying the right lead time to base stocking policies on is another important component. Probabilistic simulations available in parts planning software can be used to forecast the probability for each possible lead time that will be faced. This will result in a more accurate recommendation of what to stock compared to using a supplier quoted or average lead time.

4. SKU rationalization and master data management removes ineffective or out-of-date SKUs from the product catalog and ERP database. It also identifies different part numbers that have been used for the same SKU. The operating cost and profitability of each product are assessed during this procedure, resulting in a common list of active SKUs. Master data management software can assess product catalogs and information stored in disparate data bases to identify SKU rationalizations ensuring that inventory policies are based on the common part number.

5. Inventory control systems are key to synchronizing inventory optimization. They provide a cost-efficient way for utilities to track, monitor, and manage their inventory. They helps ensure that the utility has the right supplies and materials when and where needed while minimizing inventory costs.

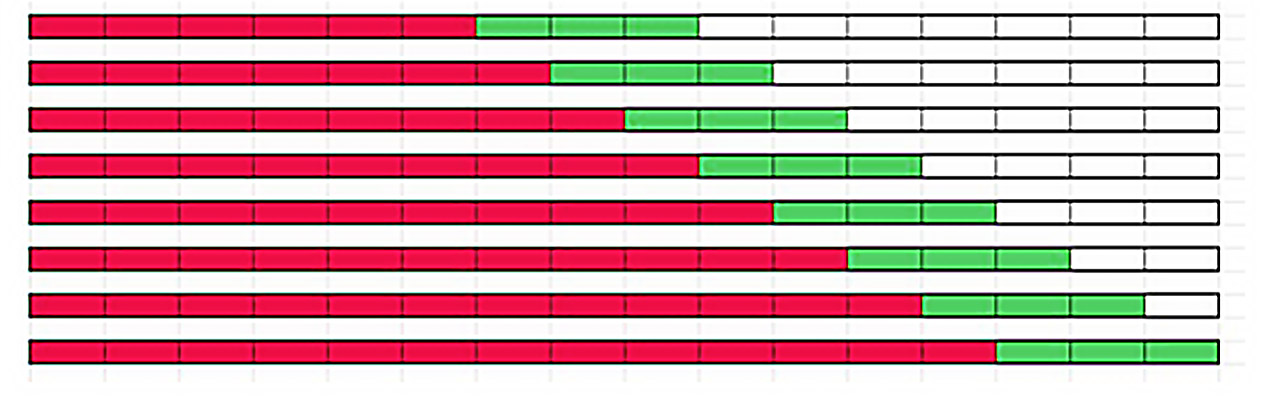

6. Continuous improvement is essential for optimizing MRO inventories. It involves regularly monitoring and adjusting inventory levels and stocking policies to ensure the most efficient use of resources. When operating conditions change, the utility must detect the change and adjust its operations accordingly. This means planning cycles must operate at a tempo high enough to stay up with changing conditions. Leveraging probabilistic forecasting to recalibrate service parts stocking policies each planning cycle ensures that stocking policies (such as min/max levels) are always up-to-date and reflect the latest parts usage and supplier lead times.

7. Planning for intermittent demand with modern Spare Parts Planning Software. The result is a highly accurate estimate of safety stocks, reorder points, and order quantities, leading to higher service levels and lower inventory costs. Smart Software’s patented probabilistic spare parts forecasting software simulates the probability for each possible demand, accurately determining how much to stock to achieve a utility’s targeted service levels. Leveraging software to accurately simulate the inflow and outflow of repairable spare parts will better predict downtime, service levels, and inventory costs associated with any chosen pool size for repairable spares.

Spare Parts Planning Software solutions

Smart IP&O’s service parts forecasting software uses a unique empirical probabilistic forecasting approach that is engineered for intermittent demand. For consumable spare parts, our patented and APICS award winning method rapidly generates tens of thousands of demand scenarios without relying on the assumptions about the nature of demand distributions implicit in traditional forecasting methods. The result is highly accurate estimates of safety stock, reorder points, and service levels, which leads to higher service levels and lower inventory costs. For repairable spare parts, Smart’s Repair and Return Module accurately simulates the processes of part breakdown and repair. It predicts downtime, service levels, and inventory costs associated with the current rotating spare parts pool. Planners will know how many spares to stock to achieve short- and long-term service level requirements and, in operational settings, whether to wait for repairs to be completed and returned to service or to purchase additional service spares from suppliers, avoiding unnecessary buying and equipment downtime.

Contact us to learn more how this functionality has helped our customers in the MRO, Field Service, Utility, Mining, and Public Transportation sectors to optimize their inventory. You can also download the Whitepaper here.

White Paper: What you Need to know about Forecasting and Planning Service Parts

This paper describes Smart Software’s patented methodology for forecasting demand, safety stocks, and reorder points on items such as service parts and components with intermittent demand, and provides several examples of customer success.