If you are a new professional in the field of demand planning and inventory management, you face a very steep learning curve. There are many moving parts in the system you manage, and much of the movement is random. You may find it helpful to take a step back from the day-to-day flow to think about what it takes to be a successful demand planner. Here are six tips for new demand planners that you may find useful; they are distilled from working over thirty five years with some very smart practitioners.

1. Know what winning means.

Inventory management and demand planning is not a squishy area where success can be described in vague language. Success here is a numbers game. There a number of key performance indicators (KPI’s) available to you, including Service Level, Fill Rate, Inventory Turns, Inventory Investment, and Inventory Operating Cost. Companies differ in the importance they assign to each metric such, but you can’t win without using some or all of these to keep score.

But “winning” is not as simple as getting the best possible score on each metric. The metric values that are most important vary across companies. Your company may prioritize customer service over cost control, or vice versa, and next year it might have reason to reverse that preference.

Furthermore, there are linkages among KPI’s that require you to think of them simultaneously rather than as a collection of independent scores. For example, improving Service Level will usually also improve Fill Rate, which is good, but it will also usually increase Operating Cost, which is not good.

These linkages express themselves as tradeoffs. And while the KPI’s themselves are numbers, the management of the bundle of KPI’s requires some wise subjectivity, because what is needed is a reasonable balance among competing forces. The fundamental tradeoff is to balance the cost of having inventory against the value of having the inventory available to those who need it.

If you are relatively junior demand planner, these tradeoff judgments may be made higher in the organization, but even then you can play a useful role by insuring that the tradeoffs are exposed and appreciated. This means exposed at a quantitative level, e.g., “We can increase Service Level from 85% to 90%, but it will require $100K more stock in the warehouse.” This kind of specific quantitative knowledge can be provided by advanced supply chain analytics.

2. Keep score.

We’re all a bit squeamish about being measured, but confident professionals insist on keeping score. Enlightened supervisors understand that external forces can ding the performance of your system (e.g., a key supplier disappears), and that always helps. But whether or not you have good top cover, you cannot demonstrate success, nor can you react to problems, without measuring those KPI’s.

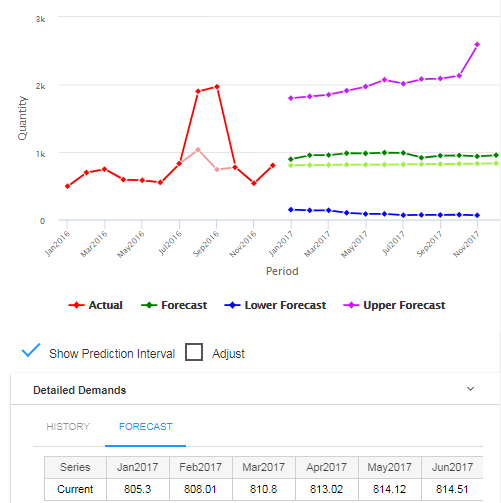

Keeping score is important, but so is understanding what influences score. Suppose your Service Level has dropped from last month’s value. Is that just the usual month-to-month fluctuation or is it something out of the ordinary? If it is problematic, then you need to diagnose the problem. Often there are several possible suspects. For example, Service Level can drop because the sales and marketing folks did something great and demand has spiked, or because a supplier did something not so great and replenishment lead time has tanked. Software can help you track these key inputs to help your detective work, and supply chain analytics can estimate the impacts of changes in these inputs and point you to compensating responses.

3. Be sure your decisions are fact-based.

Software can guide you to good decisions, but only if you let it. Inputs such as holding costs, ordering costs, and shortage costs need to be well estimated to get accurate assessment of tradeoffs. Especially important is something as apparently simple as using correct values for item demand, since modeling demand is the starting point for simulating the results of any proposed inventory system design. In fact, if we are willing to stretch the meaning of “fact” a bit to include the results of system simulations, you should not commit to major changes without having reliable predictions of what will happen when you commit to those changes.

4. Realize that yesterday’s answer may not be today’s answer.

Supply chains are collections of parts, all of which are subject to change over time. Demand that is trending up may start to trend down. Replenishment lead times may slip. Supplier order minima may increase. Component prices may increase due to tariffs. Such factors mean that the facts you collected yesterday can be out of date today, making yesterday’s decisions inappropriate for today’s problems. Vigilance. Check out a prior article detailing the adverse financial impact of infrequent updates to planning parameters.

5. Give each item its due.

If you are responsible for forecasting hundreds or thousands of inventory items, you will be tempted to simplify your life by adopting a “one size fits all” approach. Don’t. SKU’s aren’t exactly like snowflakes, but some differentiation is required to do your job well. It’s a good idea to form groups of items based on some salient characteristics. Some items are critical and must (almost) always be available; others can run some reasonable risk of being backordered. Some items are quite unpredictable because they are “intermittent” (i.e., have lots of zero values with nonzero values mixed in at random); others have high volume and are reasonably predictable. Some items can be managed with relatively inexpensive inventory methods that make adjustments every month; some items need methods that continuously monitor and adjust the stock on hand. Some items, such as contractual purchases, may be so predictable that you can treat them as “planned demand” and pull them out from the rest.

Once you have formed sensible item groups, you still have decisions to make about each item in each group, such as deciding their demand forecasts, reorder points and order quantities. Here advanced demand planning software can take over and automatically compute the best choices based on what winning means in the context of that group.

6. Get everybody on the same page.

Being organized is not only pleasing, it’s efficient. If you have a system for demand planning and inventory management, then everybody on your team shares the same objectives and follows the same processes. If you don’t have a system, then every demand planner has his or her own way of thinking about the problem and making decisions. Some of those are bound to be better than others. It’s desirable to standardize on the best practices and ban the rest. Besides being more efficient, having a standardized process makes it easier to diagnose problems when things go wrong and to implement fixes.

Related Posts

Forecast-Based Inventory Management for Better Planning

Forecast-based inventory management, or MRP (Material Requirements Planning) logic, is a forward-planning method that helps businesses meet demand without overstocking or understocking. By anticipating demand and adjusting inventory levels, it maintains a balance between meeting customer needs and minimizing excess inventory costs. This approach optimizes operations, reduces waste, and enhances customer satisfaction.

Make AI-Driven Inventory Optimization an Ally for Your Organization

In this blog, we will explore how organizations can achieve exceptional efficiency and accuracy with AI-driven inventory optimization. Traditional inventory management methods often fall short due to their reactive nature and reliance on manual processes. Maintaining optimal inventory levels is fundamental for meeting customer demand while minimizing costs. The introduction of AI-driven inventory optimization can significantly reduce the burden of manual processes, providing relief to supply chain managers from tedious tasks.

The Importance of Clear Service Level Definitions in Inventory Management

Inventory optimization software that supports what-if analysis will expose the tradeoff of stockouts vs. excess costs of varying service level targets. But first it is important to identify how “service levels” is interpreted, measured, and reported. This will avoid miscommunication and the false sense of security that can develop when less stringent definitions are used. Clearly defining how service level is calculated puts all stakeholders on the same page. This facilitates better decision-making.