What’s all the hoopla around the term “probabilistic forecasting?” Is it just a more recent marketing term some software vendors and consultants have coined to feign innovation? Is there any real tangible difference compared to predecessor “best fit” techniques? Aren’t all forecasts probabilistic anyway?

To answer this question, it is helpful to think about what the forecast really is telling you in terms of probabilities. A “good” forecast should be unbiased and therefore yield a 50/50 probability being higher or lower than the actual. A “bad” forecast will build in subjective buffers (or artificially depress the forecast) and result in demand that is either biased high or low. Consider a salesperson that intentionally reduces their forecast by not reporting sales they expect to close to be “conservative.” Their forecasts will have negative forecast bias as actuals will nearly always be higher than what they predicted. On the other hand, consider a customer that provides an inflated forecast to their manufacturer. Worried about stockouts, they overestimate demand to ensure their supply. Their forecast will have a positive bias as actuals will nearly always be lower than what they predicted.

These types of one-number forecasts described above are problematic. We refer to these predictions as “point forecasts” since they represent one point (or a series of points over time) on a plot of what might happen in the future. They don’t provide a complete picture because to make effective business decisions such as determining how much inventory to stock or the number of employees to be available to support demand requires detailed information on how much lower or higher the actual will be! In other words, you need the probabilities for each possible outcome that might occur. So, by itself, the point forecast isn’t probabilistic one.

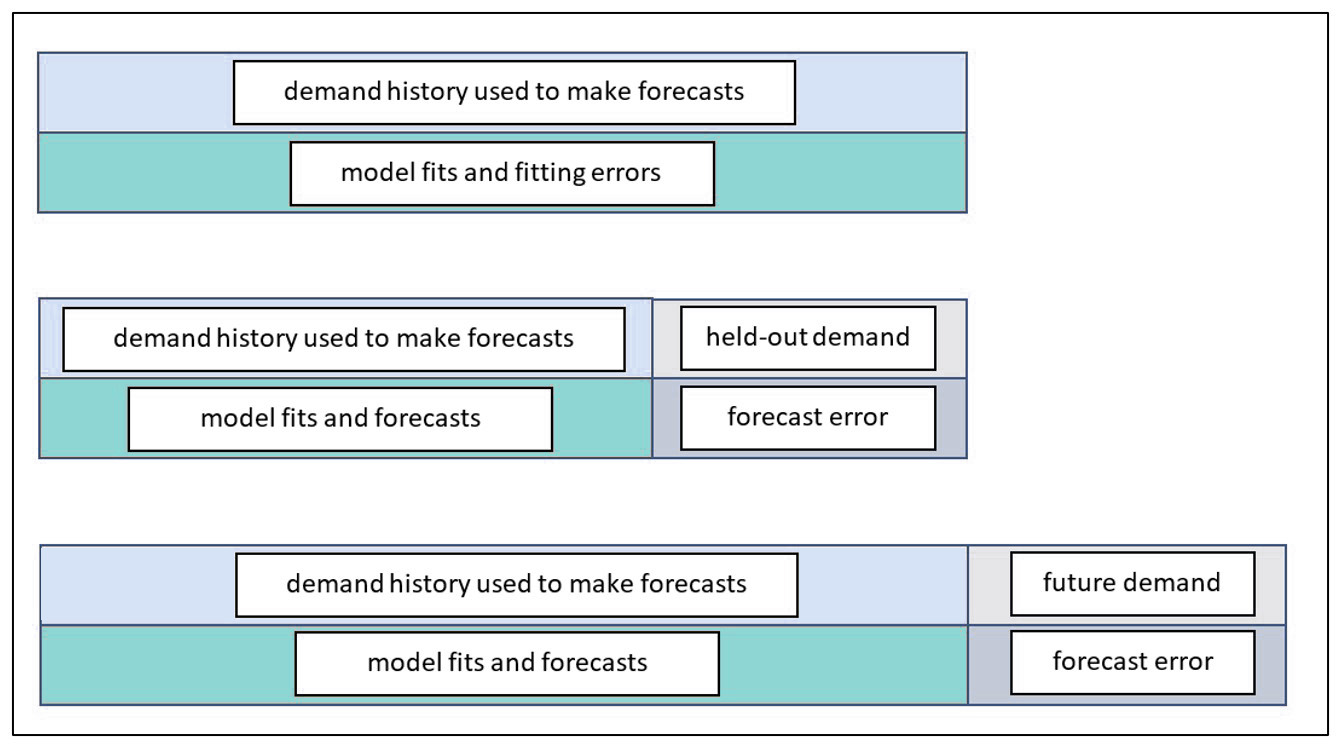

To get a probabilistic forecast, you need to know the distribution of possible demands around that forecast. Once you compute this, the forecast becomes “probabilistic.” How forecasting systems and practitioners such as demand planners, inventory analysts, material managers, and CFOs determine these probabilities is the heart of the question: “what makes a forecast probabilistic?”

Normal Distributions

Most forecasts and the systems/software that produce them start with a prediction of demand. Then they figure out the range of possible demands around that forecast by making incorrect theoretical assumptions about the distribution. If you’ve ever used a “confidence interval” in your forecasting software, this is based on a probability distribution around the forecast. The way this range of demand is determined is to assume a particular type of distribution. Most often this means assuming a bell shaped, otherwise known as a normal distribution. When demand is intermittent, some inventory optimization and demand forecasting systems may assume the demand is Poisson shaped.

After creating the forecast, the assumed distribution is slapped around the demand forecast and you then have your estimate of probabilities for every possible demand – i.e., a “probabilistic forecast.” These estimates of demand and associated probabilities can then be used to determine extreme values or anything in between if desired. The extreme values at the upper percentiles of the distribution (i.e., 92%, 95%, 99%, etc.) are most often used as inputs to inventory control models. For example, reorder points for critical spare parts in an electrical utility might be planned based on a 99.5% service level or even higher. While a non-critical service part might be planned at an 85% or 90% service level.

The problem with making assumptions about the distribution is that you’ll get these probabilities wrong. For example, if the demand isn’t normally distributed but you are forcing a bell shaped/normal curve on the forecast then how can then the probabilities will be incorrect. Specifically, you might want to know the level of inventory needed to achieve a 99% probability of not running out of stock and the normal distribution will tell you to stock 200 units. But when compared to the actual demand, you come to find out that 200 units only filled demand entirely in 40/50 observations. So, instead of getting a 99% service level you only achieved an 80% service level! This is a gigantic miss resulting from trying to fit a square peg into a round hole. The miss would have led you to take an incorrect inventory reduction.

Empirically Estimated Distributions are Smart

To produce a smart (read accurate) probabilistic forecast you need to first estimate the distribution of demand empirically without any naïve assumptions about the shape of the distribution. Smart Software does this by running tens of thousands of simulated demand and lead time scenarios. Our solution leverages patented techniques that incorporate Monte Carlo simulation, Statistical Bootstrapping, and other methods. The scenarios are designed to simulate real life uncertainty and randomness of both demand and lead times. Actual historical observations are utilized as the primary inputs, but the solution will give you the option of simulating from non-observed values as well. For example, just because 100 units was the peak historical demand, that doesn’t mean you are guaranteed to peak out at 100 in the future. After the scenarios are done you will know the exact probability for each outcome. The “point” forecast then becomes the center of that distribution. Each future period over time is expressed in terms of the probability distribution associated with that period.

Leaders in Probabilistic Forecasting

Smart Software, Inc. was the first company to ever introduce statistical bootstrapping as part of a commercially available demand forecasting software system twenty years ago. We were awarded a US patent at the time for it and named a finalist in the APICS Corporate Awards of Excellence for Technological Innovation. Our NSF Sponsored research that led to this and other discoveries were instrumental in advancing forecasting and inventory optimization. We are committed to ongoing innovation, and you can find further information about our most recent patent here.