Every organization that runs equipment needs spare parts. All of them must cope with issues that are generic no matter what their business. Some of the problems, however, are industry specific. This post discusses one universal problem that manifested in a nuclear plant and one that is especially acute for any electric utility.

The Universal Problem of Data Quality

We often post about the benefits of converting parts usage data into smart inventory management decisions. Advanced probability modeling supports generation of realistic demand scenarios that feed into detailed Monte Carlo simulations that expose the consequences of decisions such as choices of Min and Max governing the replenishment of spares.

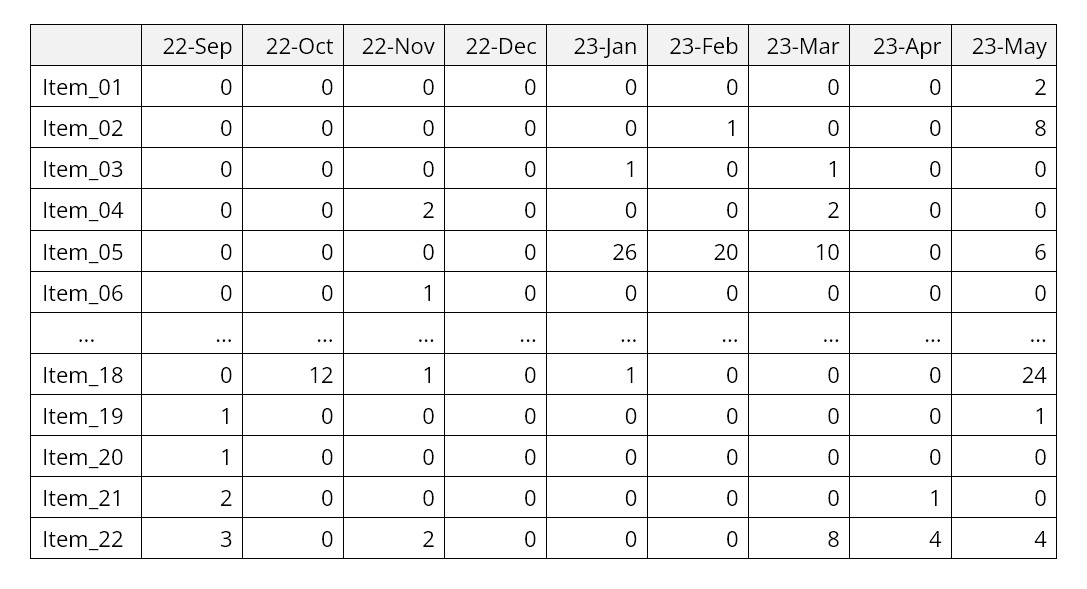

However, all that new and shiny analytical tech requires quality data as fuel for the analysis. For some public utilities of all kinds, record keeping is not a strong suit, so the raw material going into analysis can be corrupted and misleading. We recently chanced upon documentation of a stark example of this problem at a nuclear power plant (see Scala, Needy and Rajgopal: Decision making and tradeoffs in the management of spare parts inventory at utilities. American Association of Engineering Management, 30th ASEM National Conference, Springfield, MO. October 2009). Scala et al. documented the usage history of a critical part whose absence would result in either a facility de-rate or a shutdown. The plant’s usage record for that part spanned more than eight years of data. During that time, the official usage history reported nine events in which positive demand occurred with sizes ranging from one to six units each. There were also five events marked by negative demands (i.e., returns to warehouse) ranging from one to three units each. Careful sleuthing discovered that the true usage occurred in just two events, both with demand of two units. Obviously, calculating the best Min/Max values for this item requires accurate demand data.

The Special Problem of Health and Safety

In the context of “regular” businesses, shortages of spare parts can damage both current revenue and future revenue (related to reputation as a reliable supplier). For an electric utility, however, Scala et al. noted a much greater level of consequence attached to stockouts of spare parts. These include not only a heightened financial and reputational risk but also risks to health and safety: “Ramifications of not having a part in stock include the possibility of having to reduce output or quite possibly, even a plant shut down. From a more long-term perspective, doing so might interrupt the critical service of power to residential, commercial, and/or industrial customers, while damaging the company’s reputation, reliability, and profitability. An electric utility makes and sells only one product: electricity. Losing the ability to sell electricity can be seriously damaging to the company’s bottom line as well its long-term viability.”

All the more reason for electric utilities to be leaders rather than laggards in the deployment of the most advanced probability models for demand forecasting and inventory optimization.

Spare Parts Planning Software solutions

Smart IP&O’s service parts forecasting software uses a unique empirical probabilistic forecasting approach that is engineered for intermittent demand. For consumable spare parts, our patented and APICS award winning method rapidly generates tens of thousands of demand scenarios without relying on the assumptions about the nature of demand distributions implicit in traditional forecasting methods. The result is highly accurate estimates of safety stock, reorder points, and service levels, which leads to higher service levels and lower inventory costs. For repairable spare parts, Smart’s Repair and Return Module accurately simulates the processes of part breakdown and repair. It predicts downtime, service levels, and inventory costs associated with the current rotating spare parts pool. Planners will know how many spares to stock to achieve short- and long-term service level requirements and, in operational settings, whether to wait for repairs to be completed and returned to service or to purchase additional service spares from suppliers, avoiding unnecessary buying and equipment downtime.

Contact us to learn more how this functionality has helped our customers in the MRO, Field Service, Utility, Mining, and Public Transportation sectors to optimize their inventory. You can also download the Whitepaper here.

White Paper: What you Need to know about Forecasting and Planning Service Parts

This paper describes Smart Software’s patented methodology for forecasting demand, safety stocks, and reorder points on items such as service parts and components with intermittent demand, and provides several examples of customer success.