In a highly configurable manufacturing environment, forecasting finished goods can become a complex and daunting task. The number of possible finished products skyrockets when many components are interchangeable. A traditional MRP would force us to forecast every single finished product, which can be unrealistic or even impossible. Several leading solutions introduce the concept of the “Planning BOM,” which allows the use of forecasts at a higher level in the manufacturing process. In this article, we will discuss this functionality in Epicor Kinetic and how you can take advantage of it with Epicor Smart Inventory Planning and Optimization (Smart IP&O) to get ahead of your demand in the face of this complexity.

Why Would I Need a Planning BOM?

Traditionally, each finished product or SKU would have a rigidly defined bill of materials. If we stock that product and want to plan around forecasted demand, we will forecast demand for those products and then feed MRP to blow this forecasted demand from the finished good level down to its components via the BOM.

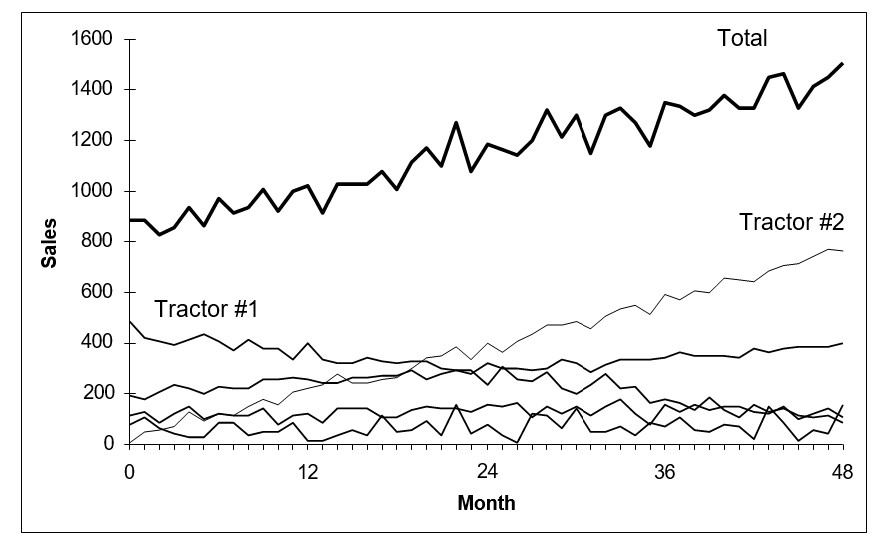

Many companies, however, offer highly configurable products where customers can select options on the product they buy. As an example, recall the last time you bought a cellphone. You chose a brand and model, but from there, you were likely presented with options: what screen size do you want? How much storage do you want? What color do you prefer? If that business wants to have these cellphones ready and available to ship to you in a reasonable time, suddenly, they are no longer just anticipating demand for that model—they must forecast that model for every type of screen size, for all storage capacities, for all colors, and all possible combinations of those as well! For some manufacturers, these configurations can compound to hundreds or thousands of possible finished good permutations.

There may be so many possible customizations that the demand at the finished product level is completely unforecastable in a traditional sense. Thousands of those cellphones may sell every year, but for each possible configuration, the demand may be extremely low and sporadic—perhaps certain combinations sell once and never again.

This often forces these companies to plan reorder points and safety stock levels mostly at the component level, while largely reacting to firm demand at the finished good level via MRP. While this is a valid approach, it lacks a systematic way to leverage forecasts that may account for anticipated future activity such as promotions, upcoming projects, or sales opportunities. Forecasting at the “configured” level is effectively impossible, and trying to weave in these forecast assumptions at the component level isn’t feasible either.

Planning BOM Explained This is where Planning BOMs come in. Perhaps the sales team is working on a big B2B opportunity for that model, or there’s a planned promotion for Cyber Monday. While trying to work in those assumptions for every possible configuration isn’t realistic, doing it at the model level is totally doable—and tremendously valuable.

The Planning BOM can use a forecast at a higher level and then blow demand down based on predefined proportions for its possible components. For example, the cellphone manufacturer may know that most people opt for 128GB of storage, and far fewer opt for upgrades to 256GB or 512GB. The planning BOM allows the organization to (for example) blow 60% of the demand down to the 128GB option, 30% to the 256GB option, and 10% to the 512GB option. They could do the same for screen sizes, colors, or other available customizations.

The business can now focus its forecast at this model level, leaving the Planning BOM to determine the component mix. Clearly, defining these proportions requires some thought, but Planning BOMs effectively allows businesses to forecast what would otherwise be unforecastable.

The Importance of a Good Forecast

Of course, we still need a good forecast to load into Epicor Kinetic. As explained in this article, while Epicor Kinetic can import a forecast, it often cannot generate one, and when it does it tends to require a great deal of hard-to-use configurations that don’t often get revisited, resulting in inaccurate forecasts. It is, therefore, up to the business to come up with its own sets of forecasts, often manually produced in Excel. Forecasting manually generally presents a number of challenges, including but not limited to:

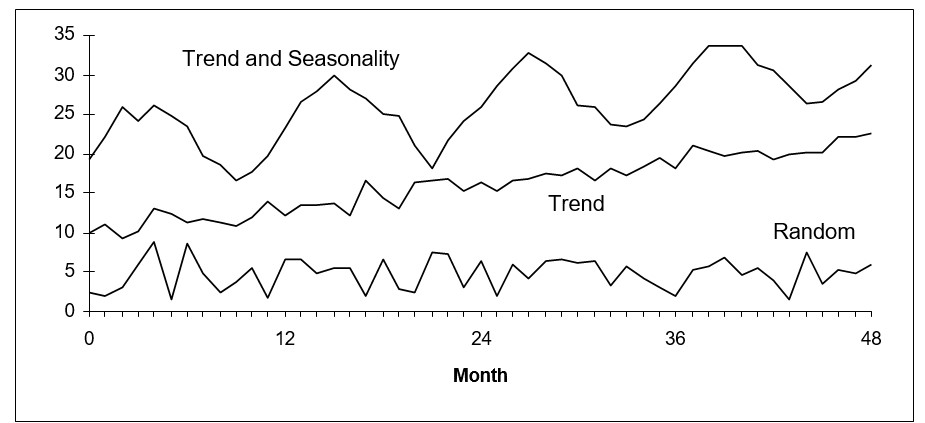

- The inability to identify demand patterns like seasonality or trend.

- Overreliance on customer or sales forecasts.

- Lack of accuracy or performance tracking.

No matter how well configured the MRP is with your carefully considered Planning BOMs, a poor forecast means poor MRP output and mistrust in the system—garbage in, garbage out. Continuing along with the “cellphone company” example, without a systematic way of capturing key demand patterns and/or domain knowledge in the forecast, MRP can never see it.

Smart IP&O: A Comprehensive Solution

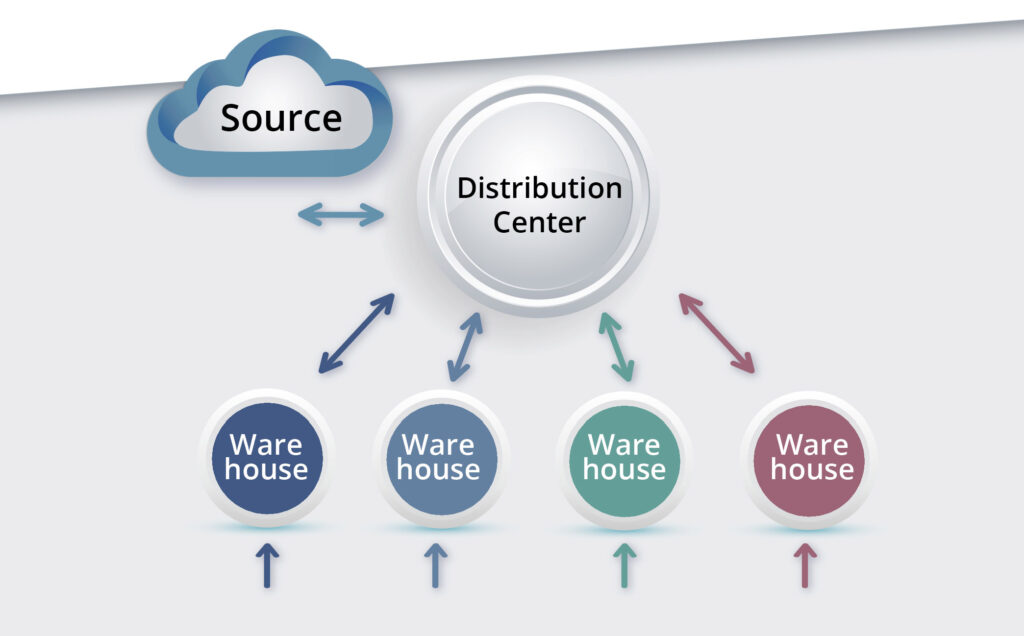

Smart IP&O supports planning at all levels of your BOM, though the “blowing out” is handled via MRP inside Epicor Kinetic. Here is the method we use for our Epicor Kinetic customers, which is straightforward and effective:

- Smart Demand Planner: The platform contains a purpose-built forecasting application called Smart Demand Planner that you will use to forecast demand for your manufactured products (usually finished goods). It generates statistical forecasts, enables planners to make adjustments and/or weave in other forecasts (such as sales or customer forecasts), and tracks accuracy. The output of this is a forecast that goes into forecast entry inside Epicor Kinetic, where MRP will pick it up. MRP will subsequently use demand at the finished good level, and also blow out material requirements through the BOM, so that demand is recognized at lower levels as well.

- Smart Inventory Optimization: You simultaneously use Smart Inventory Optimization to set min/max/safety levels both for any finished goods you make to stock (if applicable; some of our customers operate purely make-to-order off of firm demand), as well as for raw materials. The key here is that at the raw material level, Smart will leverage job usage demand, supplier lead times, etc., to optimize these parameters while at the same time using sales orders/shipments as demand at the finished good level. Smart handles these multiple inputs of demand elegantly via the bidirectional integration with Epicor Kinetic.

When MRP runs, it nets out supply & demand (which, once again, includes raw material demand blown out from the finished good forecast) against the min/max/safety levels you have established to suggest PO and job suggestions.

Extend Epicor Kinetic with Smart IP&O

Smart IP&O is designed to extend your Epicor Kinetic system with many integrated demand planning and inventory optimization solutions. For example, it can generate statistical forecasts automatically for large numbers of items, allows for intuitive forecast adjustments, tracks forecast accuracy, and ultimately allows you to generate true consensus-based forecasts to better anticipate the needs of your customers.

Thanks to highly flexible product hierarchies, Smart IP&O is perfectly suited to forecasting at the Planning BOM level, so you can capture key patterns and incorporate business knowledge at the levels that matter most. Furthermore, you can analyze and deploy optimal safety stock levels at any level of your BOM.

Leveraging Epicor Kinetic’s Planning BOM capabilities alongside Smart IP&O’s advanced forecasting and inventory optimization features ensures that you can meet demand efficiently and accurately, regardless of the complexity of your product configurations. This synergy not only enhances forecast accuracy but also strengthens overall operational efficiency, helping you stay ahead in a competitive market.