MRO organizations exist in a wide range of industries, including public transit, electrical utilities, wastewater, hydro power, aviation, and mining. To get their work done, MRO professionals use Enterprise Asset Management (EAM) and Enterprise Resource Planning (ERP) systems. These systems are designed to do a lot of jobs. Given their features, cost, and extensive implementation requirements, there is an assumption that EAM and ERP systems can do it all.

For example, at a recent Maximo Utilities Working Group event, several prospects stated that “Our EAM will do that” when asked about requirements for forecasting usage, netting out supply plans, and optimizing inventory policies. They were surprised to learn it did not and wanted to know more.

In this post, we summarize the need for add-on software that addresses specialized analytics for inventory optimization, forecasting, and service parts planning.

EAM Systems

EAM systems can’t ingest forecasts of future usage – these systems simply aren’t designed to conduct supply planning and many don’t even have a place to hold forecasts. So, when an MRO business needs to net out known requirements for planned production or capital projects, an add-on application like Smart IP&O is needed.

Inventory Optimization software with features that support planning known future demand will take project-based data not maintained in the EAM system (including project start dates, duration, and when each part is expected to be needed) and compute a period-by-period forecast over any planning horizon. That “planned” forecast can be projected alongside statistical forecasts of “unplanned” demand arising from normal wear and tear. At that point, parts planning software can net out the supply and identify gaps between supply and demand. This ensures that these gaps won’t go unnoticed and result in shortages that would otherwise delay the completion of the projects. It also minimizes excess stock that would otherwise be ordered too soon and needlessly consumes cash and warehouse space. Again, MRO businesses sometimes mistakenly assume that these capabilities are addressed by their EAM package.

ERP Systems

ERP systems, on the other hand, typically do include an MRP module that is designed to ingest a forecast and net out material requirements. Processing will consider current on hand inventory, open sales orders, scheduled jobs, incoming purchase orders, any bill of materials, and items in transit while transferring between sites. It will compare those current state values to the replenishment policy fields plus any monthly or weekly forecasts to determine when to suggest replenishment (a date) and how much to replenish (a quantity).

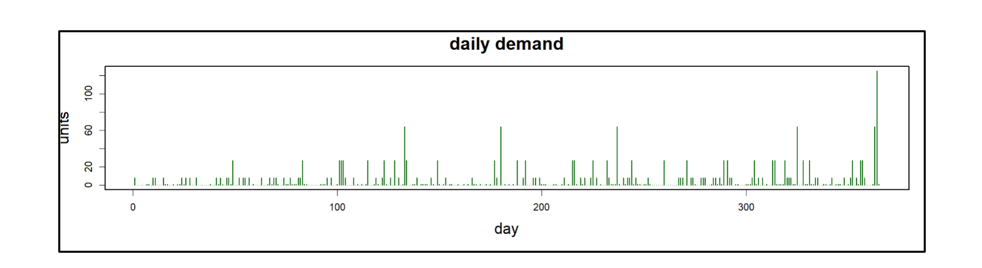

So, why not use the ERP system alone to net out the supply plan to prevent shortages and excess? First, while ERP systems have a placeholder for a forecast and some systems can net out supply using their MRP modules, they don’t make it easy to reconcile planned demand requirements associated with capital projects. Most of the time, the data on when planned projects will occur is maintained outside of the ERP, especially the project’s bill of materials detailing what parts will be needed to support the project. Second, many ERP systems don’t offer anything effective when it comes to predictive capabilities, relying instead on simple math that just won’t work for service parts due to the high prevalence of intermittent demand. Finally, ERP systems don’t have flexible user-friendly interfaces that support interacting with the forecasts and supply plan.

Reorder Point Logic

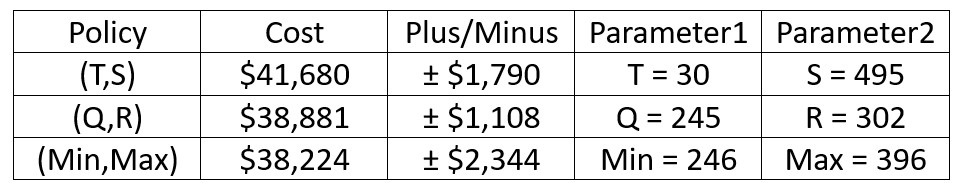

Both ERP and EAM have placeholders for reorder point replenishment methods such as Min/Max levels. You can use inventory optimization software to populate these fields with the risk-adjusted reorder point policies. Then within the ERP or EAM systems, orders are triggered whenever actual (not forecasted) demand drives on-hand stock below the Min. This type of policy doesn’t use a traditional forecast that projects demand week-over-week or month-over-month and is often referred to as “demand driven replenishment” (since orders only occur when actual demand drives stock below a user defined threshold).

But just because it isn’t using a period-over-period forecast doesn’t mean it isn’t being predictive. Reorder point policies should be based on a prediction of demand over a replenishment lead time plus a buffer to protect against demand and supply variability. MRO businesses need to know the stockout risk they are incurring with any given stocking policy. After all, inventory management is risk management – especially in MRO businesses when the cost of stockout is so high. Yet, ERP and EAM do not offer any capabilities to risk-adjust stocking policies. They force users to manually generate these policies externally or to use basic rule of thumb math that doesn’t detail the risks associated with the choice of policy.

Summary

Supply chain planning functionality such as inventory optimization isn’t the core focus of EAM and ERP. You should leverage add-on planning platforms, like Smart IP&O, that support statistical forecasting, planned project management, and inventory optimization. Smart IP&O will develop forecasts and stocking policies that can be input to an EAM or ERP system to drive daily ordering.

Spare Parts Planning Software solutions

Smart IP&O’s service parts forecasting software uses a unique empirical probabilistic forecasting approach that is engineered for intermittent demand. For consumable spare parts, our patented and APICS award winning method rapidly generates tens of thousands of demand scenarios without relying on the assumptions about the nature of demand distributions implicit in traditional forecasting methods. The result is highly accurate estimates of safety stock, reorder points, and service levels, which leads to higher service levels and lower inventory costs. For repairable spare parts, Smart’s Repair and Return Module accurately simulates the processes of part breakdown and repair. It predicts downtime, service levels, and inventory costs associated with the current rotating spare parts pool. Planners will know how many spares to stock to achieve short- and long-term service level requirements and, in operational settings, whether to wait for repairs to be completed and returned to service or to purchase additional service spares from suppliers, avoiding unnecessary buying and equipment downtime.

Contact us to learn more how this functionality has helped our customers in the MRO, Field Service, Utility, Mining, and Public Transportation sectors to optimize their inventory. You can also download the Whitepaper here.

White Paper: What you Need to know about Forecasting and Planning Service Parts

This paper describes Smart Software’s patented methodology for forecasting demand, safety stocks, and reorder points on items such as service parts and components with intermittent demand, and provides several examples of customer success.