What’s different about inventory planning for Maintenance, Repair, and Operations (MRO) compared to inventory planning in manufacturing and distribution environments? In short, it’s the nature of the demand patterns combined with the lack of actionable business knowledge.

Demand Patterns

Manufacturers and distributors tend to focus on the top sellers that generate the majority of their revenue. These items typically have high demand that is relatively easy to forecast with traditional time series models that capitalize on predictable trend and/or seasonality. In contrast, MRO planners almost always deal with intermittent demand, which is more sparse, more random, and harder to forecast. Furthermore, the fundamental quantities of interest are different. MRO planners ultimately care most about the “when” question: When will something break? Whereas the others focus on the “how much” question of units sold.

Business Knowledge

Manufacturing and distribution planners can often count on gathering customer and sales feedback, which can be combined with statistical methods to improve forecast accuracy. On the other hand, bearings, gears, consumable parts, and repairable parts are rarely willing to share their opinions. With MRO, business knowledge about which parts will be needed and when just isn’t reliable (excepting planned maintenance when higher-volume consumable parts are replaced). So, MRO inventory planning success goes only as far as their probability models’ ability to predict future usage takes them. And since demand is so intermittent, they can’t get past Go with traditional approaches.

Methods for MRO

In practice, it is common for MRO and asset-intensive businesses to manage inventories by resorting to static Min/Max levels based on subjective multiples of average usage, supplemented by occasional manual overrides based on gut feel. The process becomes a bad mixture of static and reactive, with the result that a lot of time and money is wasted on expediting.

There are alternative planning methods based more on math and data, though this style of planning is less common in MRO than in the other domains. There are two leading approaches to modeling part and machine breakdown: models based on reliability theory and “condition-based maintenance” models based on real-time monitoring.

Reliability Models

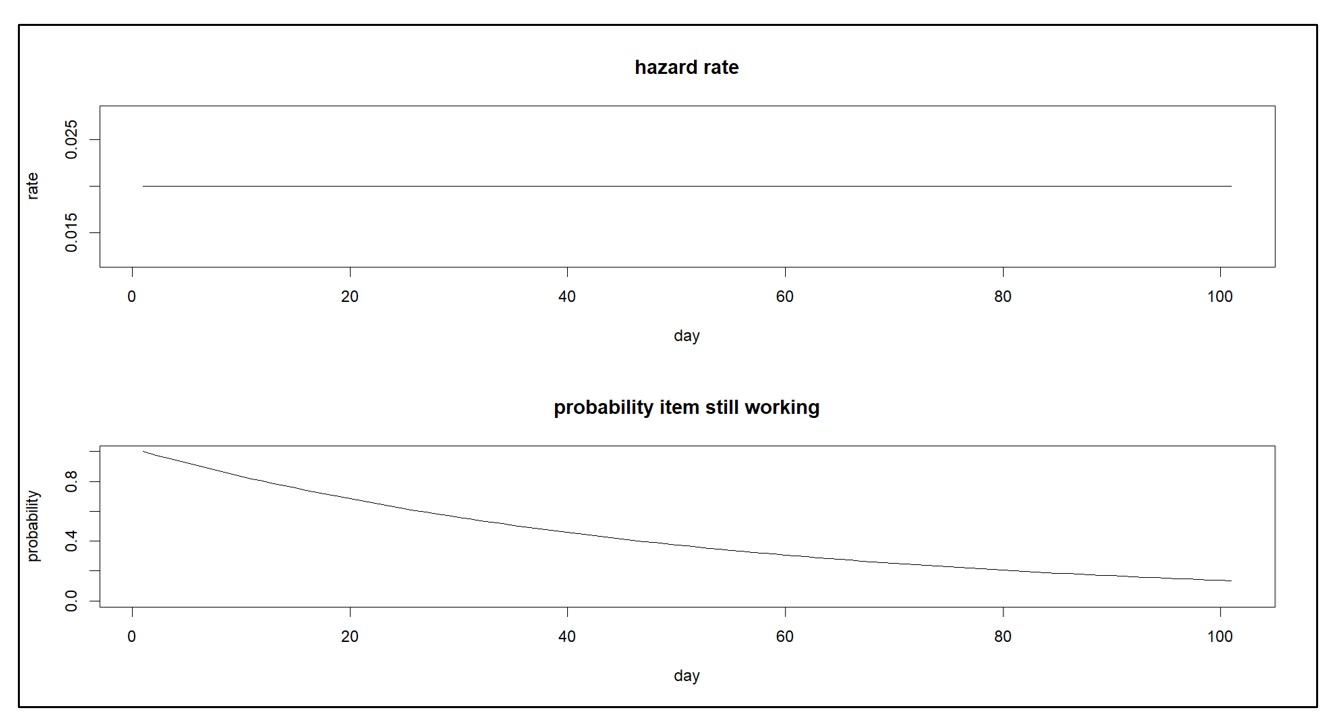

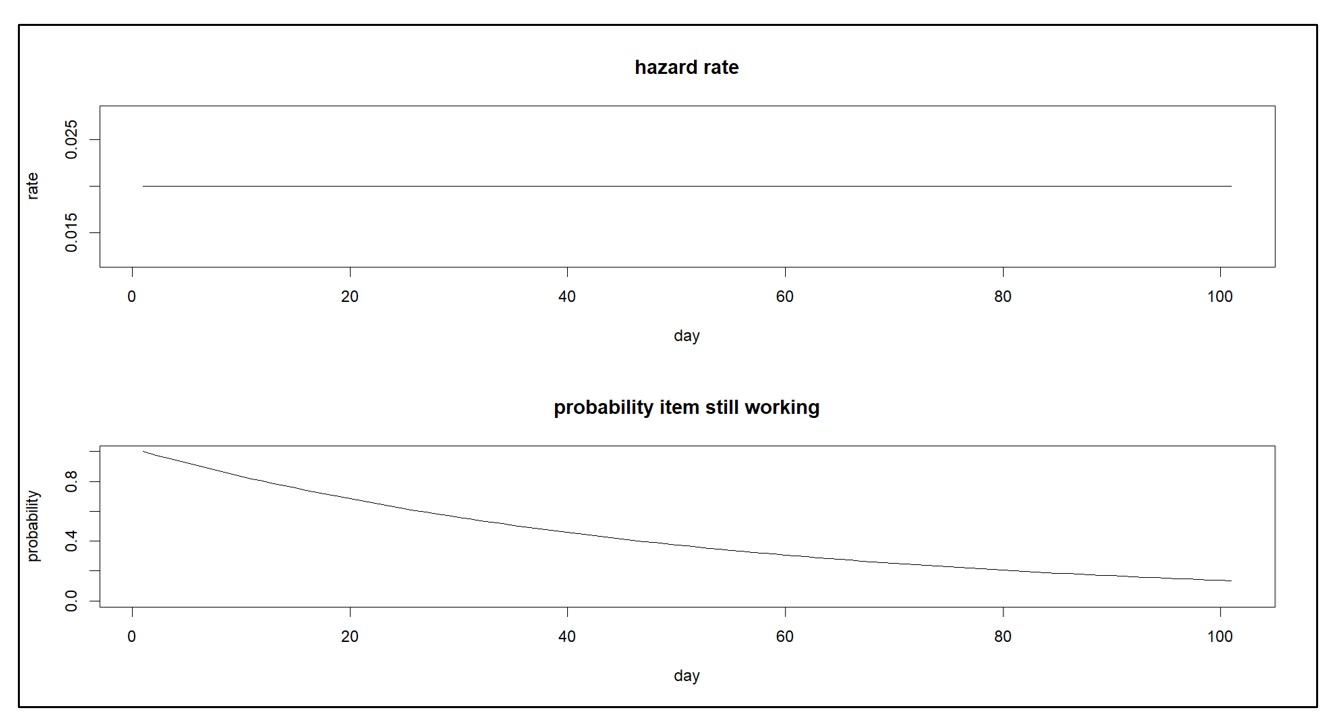

Reliability models are the simpler of the two and require less data. They assume that all items of the same type, say a certain spare part, are statistically equivalent. Their key component is a “hazard function”, which describes the risk of failure in the next little interval of time. The hazard function can be translated into something better suited for decision making: the “survival function”, which is the probability that the item is still working after X amount of use (where X might be expressed in days, months, miles, uses, etc.). Figure 1 shows a constant hazard function and its corresponding survival function.

Figure 1: Constant hazard function and its survival function

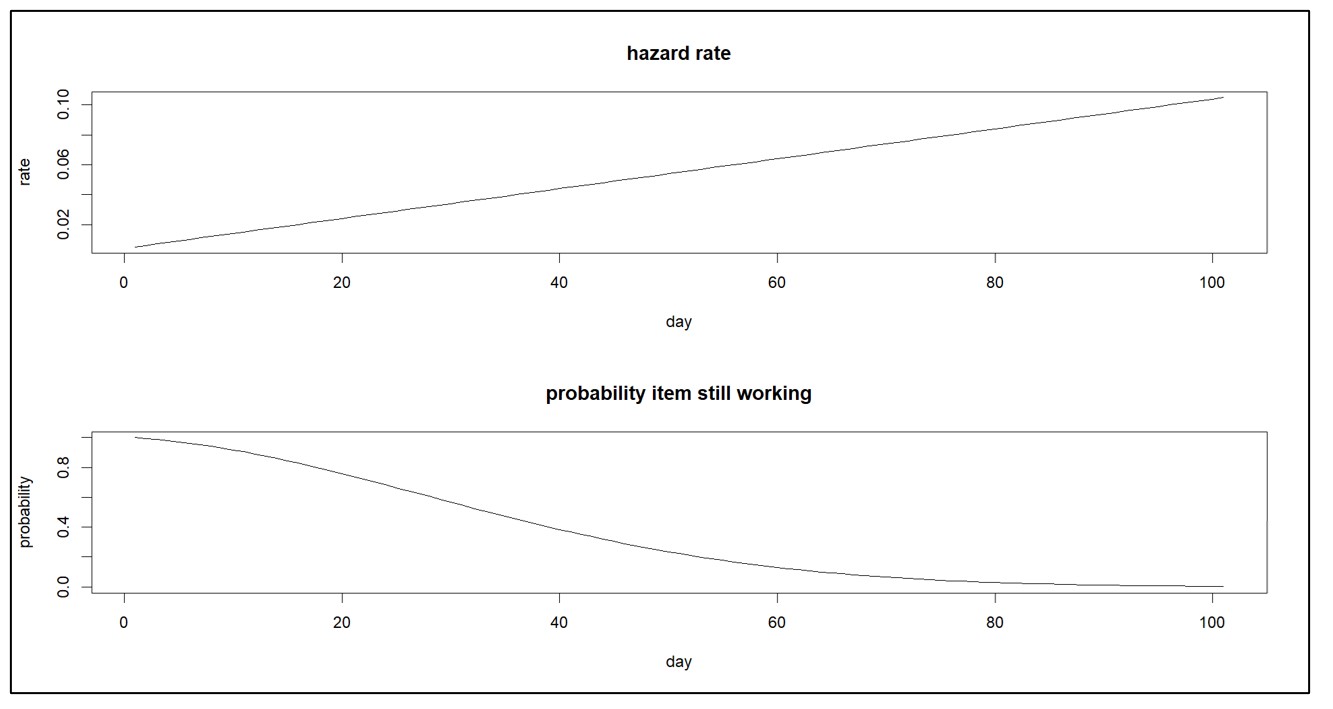

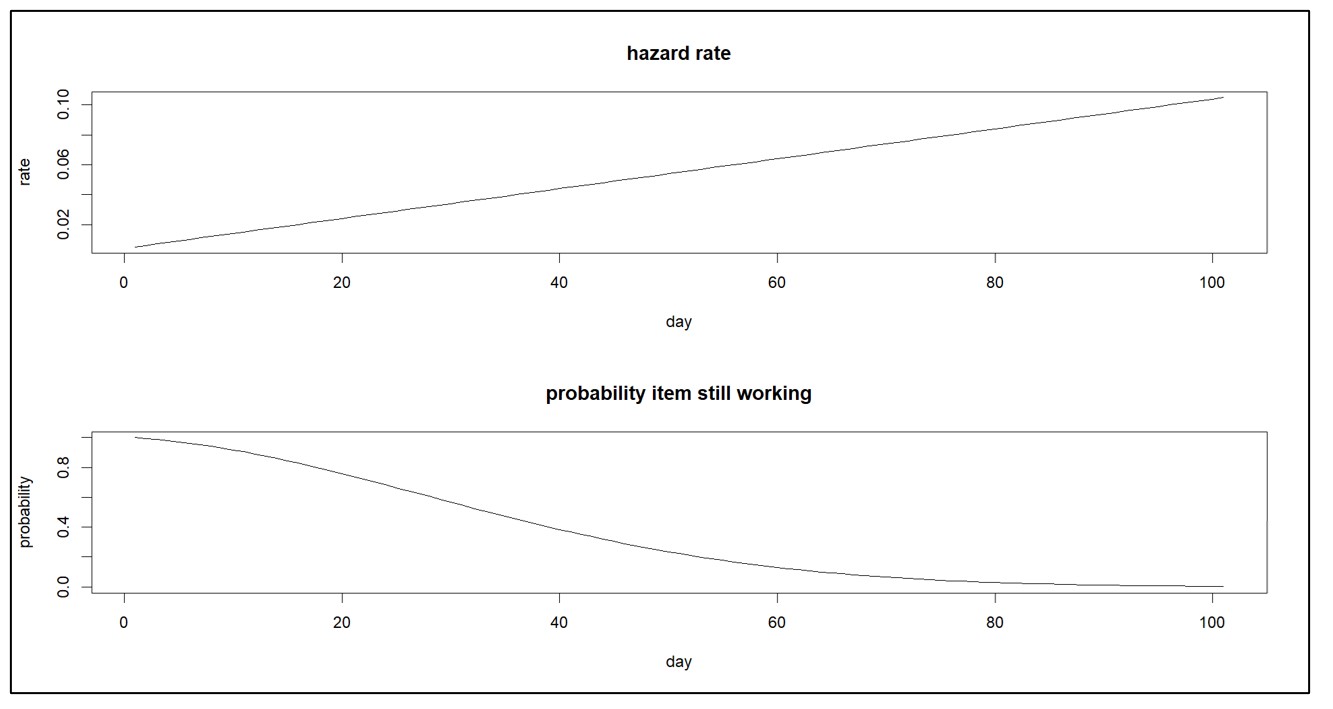

A hazard function that doesn’t change implies that only random accidents will cause a failure. In contrast, a hazard function that increases over time implies that the item is wearing out. And a decreasing hazard function implies that an item is settling in. Figure 2 shows an increasing hazard function and its corresponding survival function.

Figure 2: Increasing hazard function and its survival function

Reliability models are often used for inexpensive parts, such as mechanical fasteners, whose replacement may be neither difficult nor expensive (but still might be essential).

Condition-Based Maintenance

Models based on real-time monitoring are used to support condition-based maintenance (CBM) for expensive items like jet engines. These models use data from sensors embedded in the items themselves. Such data are usually complex and proprietary, as are the probability models supported by the data. The payoff from real-time monitoring is that you can see trouble coming, i.e., the deterioration is made visible, and forecasts can predict when the item will hit its red line and therefore need to be taken off the field of play. This allows individualized, pro-active maintenance or replacement of the item.

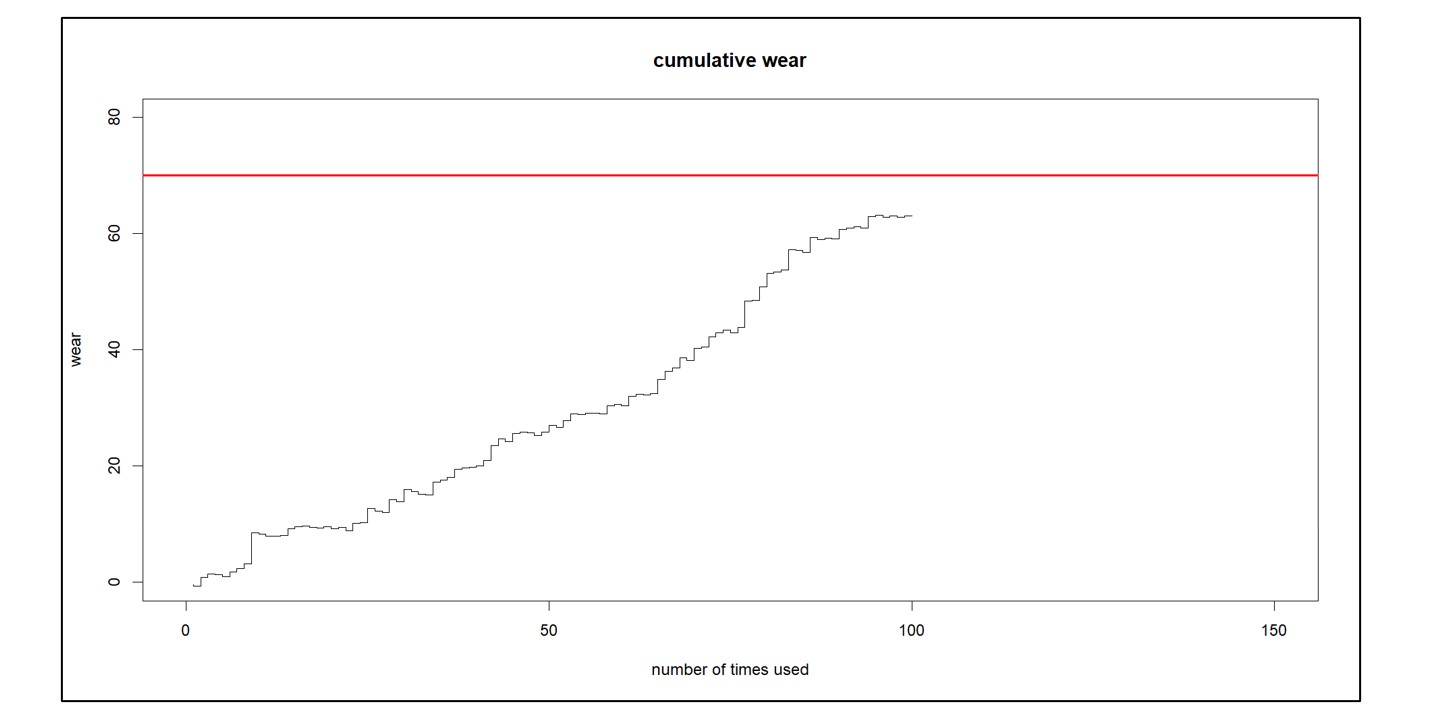

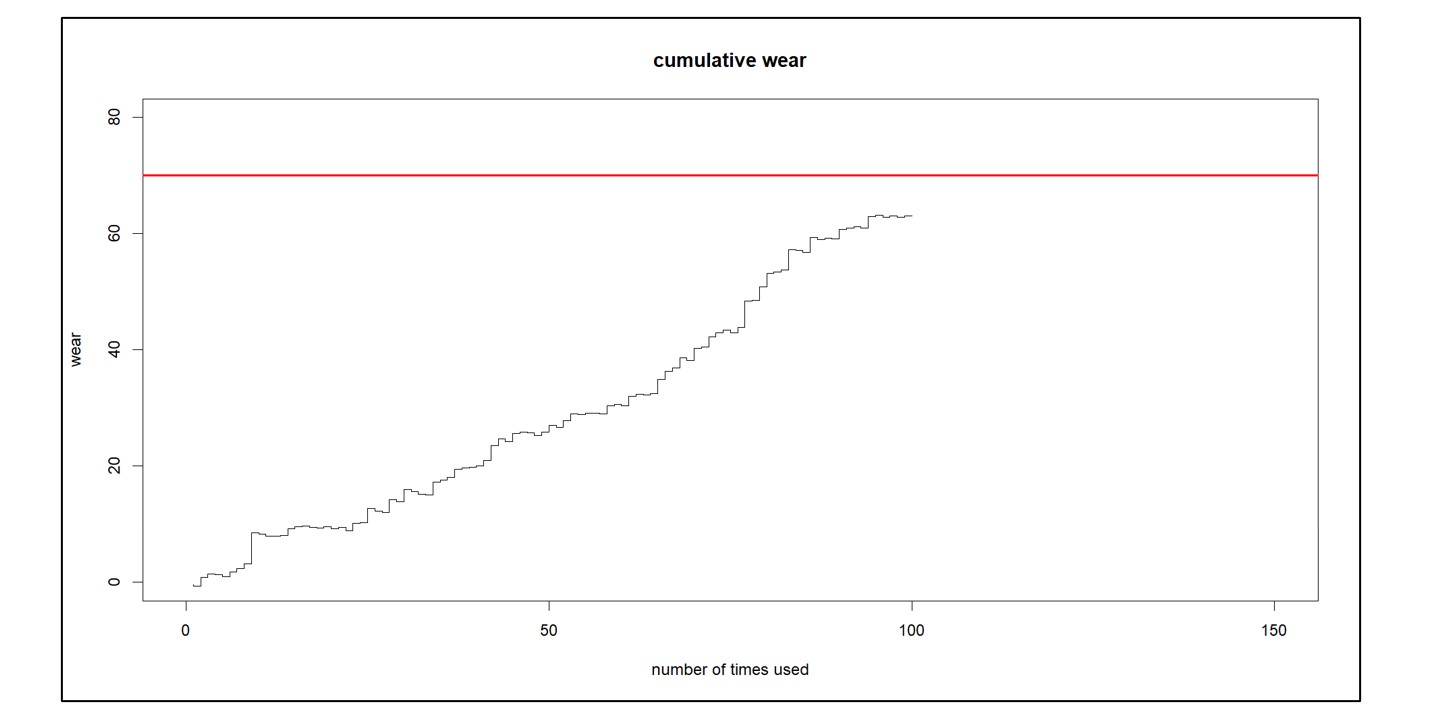

Figure 3 illustrates the kind of data used in CBM. Each time the system is used, there is a contribution to its cumulative wear and tear. (However, note that sometimes use can improve the condition of the unit, as when rain helps keep a piece of machinery cool). You can see the general trend upward toward a red line after which the unit will require maintenance. You can extrapolate the cumulative wear to estimate when it will hit the red line and plan accordingly.

Figure 3: Illustrating real-time monitoring for condition-based maintenance

To my knowledge, nobody makes such models of their finished goods customers to predict when and how much they will next order, perhaps because the customers would object to wearing brain monitors all the time. But CBM, with its complex monitoring and modeling, is gaining in popularity for can’t-fail systems like jet engines. Meanwhile, classical reliability models still have a lot of value for managing large fleets of cheaper but still essential items.

Smart’s approach

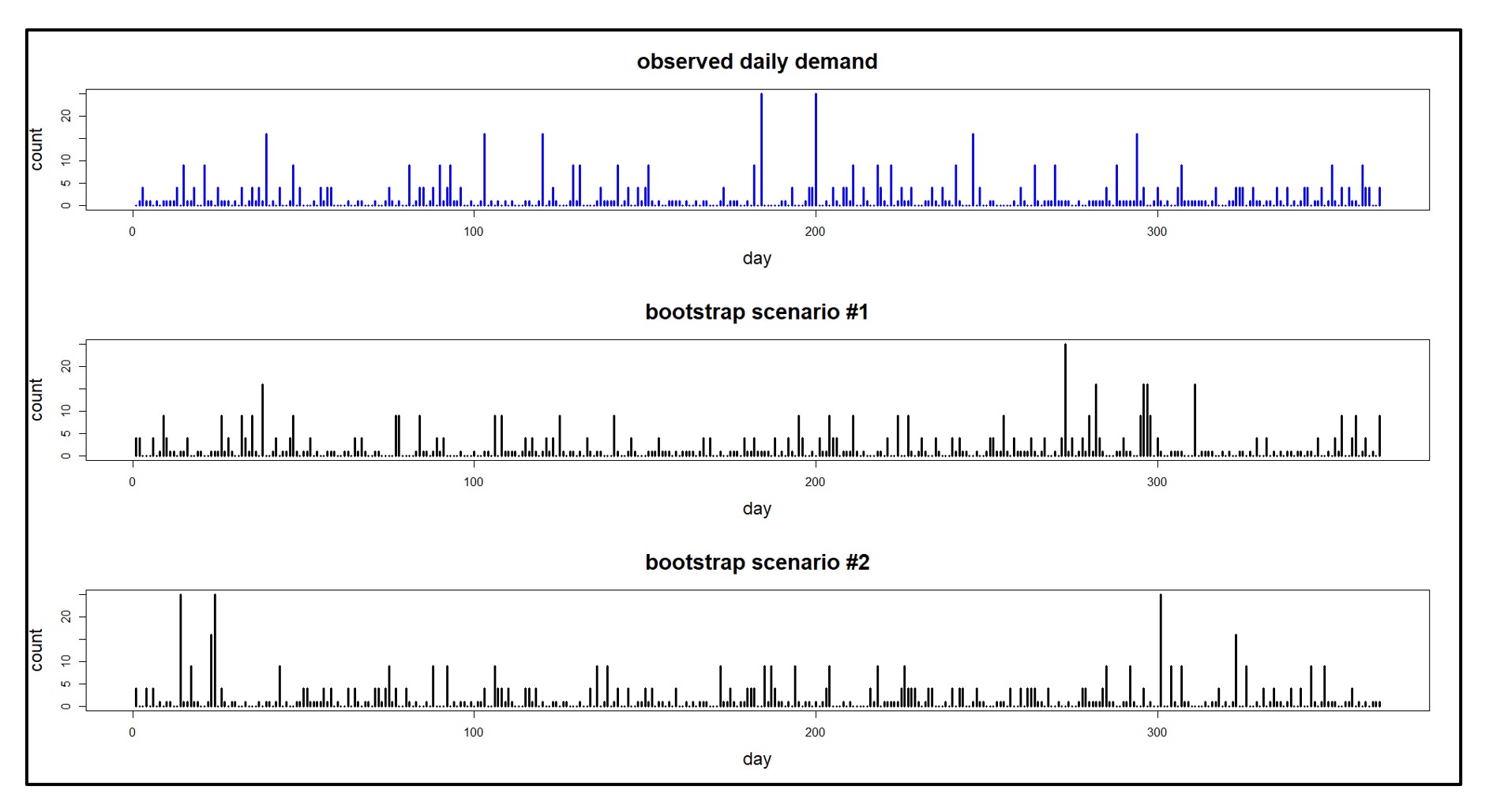

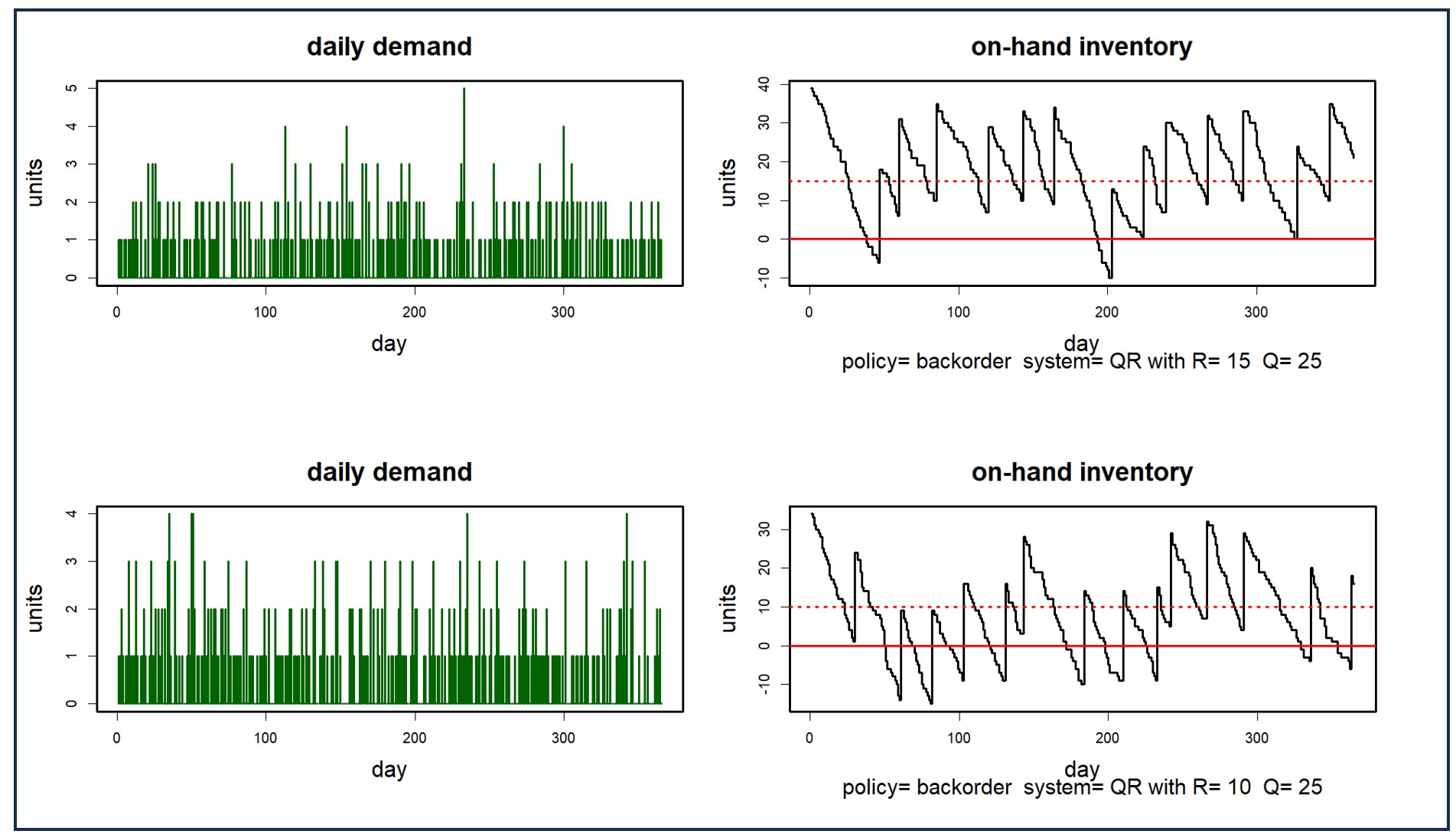

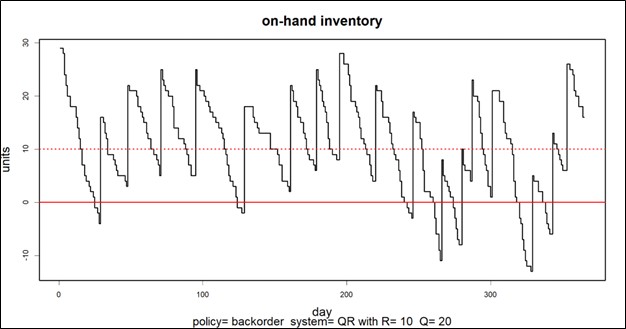

The above condition-based maintenance and reliability approaches require an excessive data collection and cleansing burden that many MRO companies are unable to manage. For those companies, Smart offers an approach that does not require development of reliability models. Instead, it exploits usage data in a different way. It leverages probability-based models of both usage and supplier lead times to simulate thousands of possible scenarios for replenishment lead times and demand. The result is an accurate distribution of demand and lead times for each consumable part that can be exploited to determine optimal stocking parameters. Figure 4 shows a simulation that begins with a scenario for spare part demand (upper plot) then produces a scenario of on-hand supply for particular choices of Min/Max values (lower line). Key Performance Indicators (KPIs) can be estimated by averaging the results of many such simulations.

Figure 4: An example of a simulation of spare part demand and on-hand inventory

You can read about Smart’s approach to forecasting spare parts here: https://smartcorp.com/wp-content/uploads/2019/10/Probabilistic-Forecasting-for-Intermittent-Demand.pdf